This week is likely to be dominated by the central bank decisions due this week. FOMC on Wednesday, ECB and SNB on Thursday. However, low IV environment still persists in the FX markets.

It is not only because any of these central banks were going to take a monetary policy step. That is not on the agenda. Instead all three central banks will have to explain their monetary policy strategy.

- The Fed will have to tell us what conditions apply to its new wait and see approach. In other words: what would have to happen for it to lower its key rate corridor again?

- ECB President Christine Lagarde will have to use the first ECB press conference to explain how the new consideration of the ECB monetary policy’s side effects will be reflected in future monetary policy decisions.

- And the SNB will once again have to clarify what its monetary policy scope looks like. Would it be at all able to lower its key rate? To what extent would it be able to intervene on the FX market? If the FX market was to assume my point of view - that there is little it can do on either front - the franc would come under increasing appreciation pressure.

Ongoing trade tensions between the US and China remain a key focus for global markets. Conflicting indications on the likelihood of a near-term deal led to market gyrations last week. This week may see even more volatility as investors look for a deal to be done before 15th December when the US is set to raise tariffs on a range of imports from China.

The underperformance of Swiss franc (CHF) through mid-April was partially driven by market expectations of an eventually benign outcome on global growth on the back of global policy easing which also culminated into FX volatility grinding to the low-end of its decade-long range.

The nascent global growth recovery and the low-vol is regime is now once again being threatened by a re-emergence of a more aggressive US trade policy. While the conditions remain fluid and US-China trade negotiations are still ongoing, a further escalation of the conflict is not likely to bode well for high beta FX and on the contrary, is likely to be supportive for defensive currencies such as CHF given our view that FX markets are currently priced to more optimistic growth outcomes.

CHF is unlikely to be immune from an escalation of trade conflict which spills into broader risk sentiment. In such an event, the channel of transmission is likely to be the market readjusting to a lower growth outcomes and pricing in more risk premia for tail risks. Recall that last year, CHF was among the best performing currencies globally amid the softer growth backdrop and escalating tail risks. While CHF has been less sensitive to changes in risk sentiment (as measured by equities) in comparison to say USD or JPY, CHF (negative) sensitivity to equity markets is the nonetheless the third largest globally. The beta has been stable for the past year but has shown signs of increasing in magnitude when market volatility increases.

3m IV skews of USDCHF are stretched for downside risks (noticeable bids for OTM puts are having higher demand), which means hedgers’ sentiments are positioned for bearish risks.

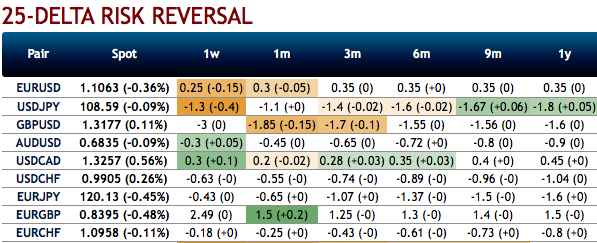

Positively skewed IVs (implied volatilities are the difference between OTM calls and OTM puts).

To substantiate this bearish stance, negative risk reversal numbers also signify hedging outlook for bearish risk sentiments.

On trading grounds, executing below options strategy as IVs are most likely to favor.

So, buy OTM -0.49 delta put while short ATM put with similar expiries, simultaneously buy OTM 0.5 delta call while simultaneously shorting an ATM call with similar expiries. This strategy is structured for a larger probability of earning a smaller but certain profit as USDCHF is perceived to have a low volatility. Courtesy: Sentrix, Saxo & Commerzbank

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  China Holds Loan Prime Rates Steady in January as Market Expectations Align

China Holds Loan Prime Rates Steady in January as Market Expectations Align  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons