Canadian data announcements have been lined up for this week, with unemployment data has disappointed as the number has risen to 7.8% from the previous 5.6%, while BoC monetary policy is scheduled on 15thfollowed by press meet, while retail sales and CPI flashes to print on 21st and 22nd respectively.

CAD softens on weak oil after OPEC+ cuts, but not enough. CAD is registering a small decline on the daily comparisons after spot nudged to the low 1.39 levels Friday while North America was closed and is rebounding in early trade now. CAD softness reflects the market’s dissatisfaction with the “historic” oil production cuts agreed by OPEC+ last week and its lack of impact on WTI (as large as the cuts are, they do not perhaps fully offset the demand destruction resulting from global slowdown).

PM Trudeau suggested that Canada may be able to loosen some lockdown conditions by the summer if social distancing measures continue to be restricted which rather implies that the recovery in the economy may be slower than had previously been thought.

USDCAD OTC Outlook And Options Strategy:

Given these concerns, it makes sense that CAD has decoupled from oil from the recent weeks as the focus on Canada's specific weaknesses grows larger. Despite the move lower in USDCAD this week, we maintain that directionality from here is higher in the pair.

Hence, add longs in USDCAD via options contemplating above fundamental factors and below OTC indications:

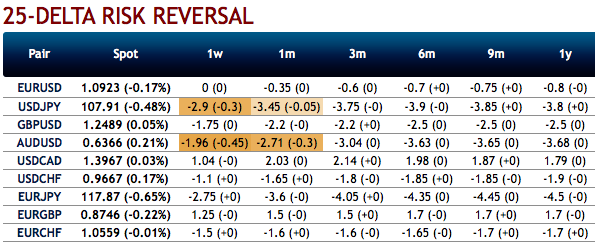

The existing bullish neutral risk reversal setup indicates the broader hedging sentiments for the upside price risks (refer 1st chart).

To substantiate this stance, the positively skewed IVs of 3m tenors are indicating the upside (refer 2nd chart), bids for deep OTM call strikes up to 1.44 levels is interpreted as the hedgers are inclined for the upside risks.

Hence, at this juncture (when spot reference: 1.3907 levels), we upheld our shorts in CAD on hedging grounds via 3-month (1.3815/1.45) debit call spread. If the scenario outlined above unfolds, we will re-assess our stance but at the moment there are no changes to our CAD recommendations. Courtesy: Sentry, Saxo & Scotiabank

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says