The dollar rally continues and the expected pause has yet to materialize. Meanwhile, the Turkish central bank has raised rates by 300 basis points to stem the slide in the lira, but even this move could prove insufficient.

The sell-off in Italian bonds continues and is increasingly spreading to the other market segments. Although we expect continued selling pressure, a self-reinforcing escalation similar to 2011 seems unlikely. 10y Bund yields should nonetheless continue to struggle below the important 0.50% mark.

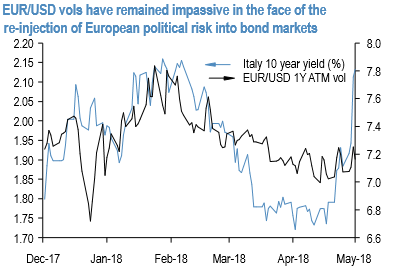

6M-1Y EURUSD ATM vol good value after re-emergence of Italian political stress: The EURUSD vol surface has appeared low and flat over the past few months, and especially cheap relative to the widening of forward points to unprecedented highs.

Despite their obvious value, a catalyst for mean-reversion in Euro vol had been difficult to pinpoint even through the ongoing turmoil in EM, especially after directional EUR call option demand – so influential in driving a mini vol surge in 3Q’17 – cooled off earlier this year alongside the bull-momentum in the spot.

The re-emergence of European political risk (Italy) over the past two weeks has finally supplied the missing piece of the jigsaw that in our view should serve to push portfolio hedgers off the fence towards a more active embrace of EUR vega in coming weeks.

Mid-to-long (6M-1Y) expiries, in particular, have remained strangely impassive in the face of the 40bp sell-off in BTPs from their lows (refer above chart) and are better value than shorter tenors along a now inverted 1M/1Y vol curve. Political uncertainty can also drag on for longer than short-dated options can withstand, and 6M expiries in particular that span the US midterm elections do not appear to price in much risk premium for the event (6M3M ATM spread 0).

A final factor supporting EUR vega ownership is the possibility of European asset managers partially switching to option-based FX hedging programs over the next few months as negative carry on standard forward based hedging programs has become too punitive; conversations with accounts suggest an inclination towards buying EURUSD call spreads to partially replace forwards and in the process reduce portfolio exposure to the double whammy of simultaneous losses on overseas assets as well as the FX hedge (both SPX and EURUSD crashed in 2008).

While timing and notional sizes of any such hedging related option uptake are difficult to quantify ex-ante, the possibility of a new source of investor demand in coming months creates asymmetric upside risks to EUR vol from current historically depressed levels. Courtesy: JPM

FxWirePro launches Absolute Return Managed Program. For more details, visit:

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts