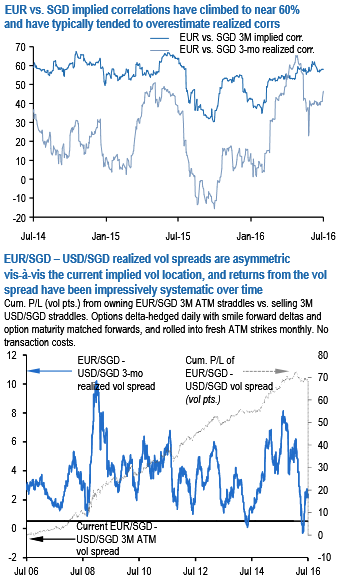

Long EUR/SGD vs. short USD/SGD gamma spreads form a classic relative value set-up with excellent entry levels, asymmetric payout profile and a long history of return outperformance. EUR vs. SGD implied correlations have recovered smartly from their Q1 lows towards 60%, and odds are that future realized corrs will fall short of this high bar as they have usually done in years past.

A direct corollary of this correlation set-up is that EUR/SGD – USD/SGD implied vols have fallen to multi-year lows, from where returns on the gamma spread are biased asymmetrically higher given the recent as well as the long run history of realized vol behavior (see chart).

The above chart also best reflects the persistent underperformance of EUR vs. SGD correlations in the form of impressive Sharpe Ratios from owning EUR/SGD vs. USD/SGD straddle spreads, indicating a degree of structural underpricing of EUR/SGD cross vols that is also shared by EUR-cross vols against other regional currencies such as KRW and INR.

While the precise cause is unclear, vega-supplying retail structured products might have a role to play in this, not dissimilar to the effect of higher profile Uridashis on JPY-cross vols spread is net time decay positive, and offers exposure to the idiosyncratic risk of INR volatility stemming from the RBI governor change and the specter of FCNR outflows.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?