As both monetary policy divergence and minimal support from commodity prices make Aussie dollar vulnerable, it is reckoned that AUDUSD is likely to decline to nudge towards 0.72 by the 2Q’18 end.

While the acceleration of domestic growth momentum is expected to plunge in 2H’18, after a boost from net exports in the first half of the year. Recent developments around the Banking Royal Commission have likely shifted risks to that forecast to the downside.

AUD has made new lows for the calendar year. Weakness in Chinese data (especially FAI), a sharp move higher in USDCNY and anxiety around trade policy all conspired to push AUD lower vs USD and other G10 crosses. AUD has fallen 1.9% against the USD in the past month which makes it the second worst G10 performer (the wooden spoon goes to its Antipodean counterpart, NZD). Performance vs a basket of currencies has been better, thanks in part to the sharp depreciation in the Chinese currency (which comprises 27.5% of the AUD TWI) (Refer above chart).

RBA commentary this year continues to reinforce Australia’s policy divergence with the G10, but the central bank now seems more comfortable with the level of AUD

Other bearish AUDUSD scenarios below 0.72 if:

1) The unemployment rate moves back towards 5.75%, raising the spectre of RBA rate cuts;

2) The Fed responds to firm labour market outcomes and above-trend growth by delivering a faster pace of hikes than currently expected;

3) China data weaken materially; or

4) The risk markets retrace and vol rises as trade war fears escalate.

OTC outlook:

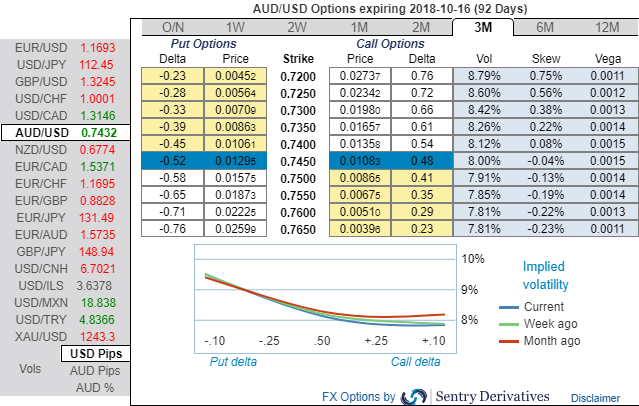

Please be noted that the positively skewed IVs of 3m tenors signify the hedgers’ interests in bearish risks.

As you can observe hedging bids for OTM put strikes upto 0.72 levels (above nutshell), the underlying spot FX seem to be discounting above-stated fundamental driving forces. While bearish neutral delta risk reversal also indicates that the hedging activities for the downside risks remain intact.

Accordingly, on hedging grounds, it is wise to advocate capitalizing on these hedging bids and use the prevailing price rallies to deploy delta longs of at-the-money put options.

Fresh delta longs for long-term hedging, more number of longs comprising of ATM instruments are suitable in low vols scenarios. Thus, activate longs in 2 lots of long in 3m ATM -0.49 delta put options. A move towards the ATM territory increases the Vega, Gamma and Delta which boosts premium.

Potential trigger events:

US retail sales for today

Aussie market on 19 Jul

CPI (2Q): 25 Jul

RBA SoMP (Aug): 10 Aug

Currency Strength Index: FxWirePro's hourly AUD spot index is inching towards 57 levels (which is bullish), while hourly USD spot index was at 12 (neutral) while articulating (at 08:37 GMT). For more details on the index, please refer below weblink:

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close