The spot reference is at 1.0597 (at the time of articulating) which is just 81 pips away from 1-year lows (i.e. 1.0516).

The 1.05 region is again seemingly providing decent support ahead of the 1.0450 lows set back in March 2015. We see the medium-term range over this support as corrective ahead of a breakdown towards 1.0250 and potentially key long-term support in the 1.01-0.99 region.

However, while over 1.05-1.0450 our intra-day studies are suggesting another bounce and consolidation can be seen as we head into the FOMC meeting

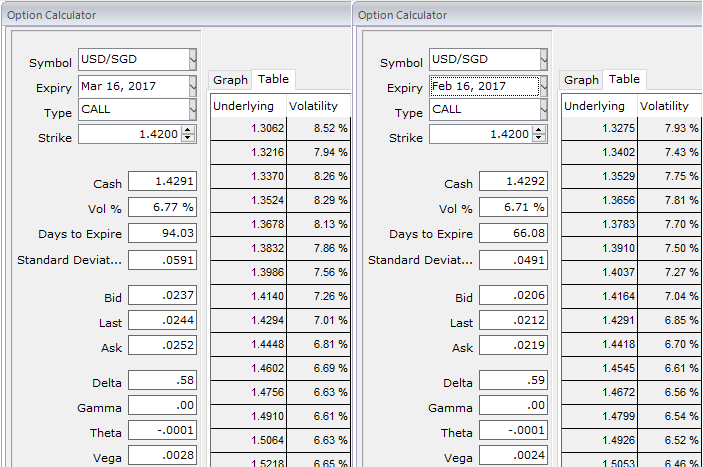

Low implied volatility within EM: The SGD has one of lowest implied vols in EM (refer IV nutshell, 3m implied volatility at 6.77%, against 9.85% for the EURUSD), posing it comparatively economical to express a directional USD view through options. We expect overall EM currency volatility to increase in coming months alongside a stronger dollar.

FX Option Strategy:

We’ve already recommended USDSGD 3m one-touch knock-in 1.4970, indicative offer: 65% (spot ref: 1.4286) a week ago.

The one-touch option has a binary payoff of either zero at expiry if the barrier level is not reached, or the notional amount if the 1.4950 barrier level is triggered at any point over the 3m tenor.

The maximum leverage is 5 times. Alternative structure: For investors who prefer a cheaper structure, a USDSGD 3m European digital strike 1.4950 costs only 12% (leverage of 8.3 times).

The rationale is that correlation is strong: The SGD reacts with a very solid correlation to the overall dollar cycle. It has been closely allied to the EURUSD in the past year and the relationship should hold going forward given the SGD NEER framework.

Risk profile: EURUSD downside stalls, the failure of the EURUSD to convincingly break through 1.05 would prevent the USDSGD from heading towards 1.50. The maximum loss of both proposals is limited to the premium paid.

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges