Overnight, the RBNZ left rates at 0.25%, but increased its QE programme, also indicating that negative rates “will become an option in the future”.

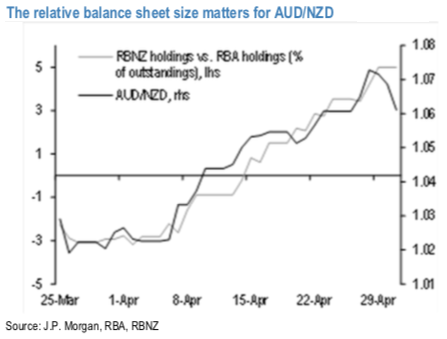

We recommended short NZD in our portfolio vs a basket of AUD and USD as partly a relative value play. Our Antipodean strategists continue to think that AUD can extend its recent outperformance against NZD with the relative QE stance a key differentiator--the RBA is already tapering QE while the RBNZ is toying with possible outright overseas investments. The relative size of the central bank balance sheet has been clearly weighing on the cross (refer 1st chart) and we expect this to be an ongoing influence.

As discussed in the outlook, NZD is among the most vulnerable G10 FX given the combination of a current account deficit and an aggressive central bank effectively absorbing a large chunk of a large fiscal deficits.

Hence, stay short in NZD vs basket of AUD and USD in cash and options.

Sold NZD vs a 50:50 basket of USD & AUD on 24 April at an average spot rate of 0.771, and a stop loss at 0.794. Marked at -0.53%.

OTC Updates and Hedging Strategies:

Let’s now quickly glance through OTC updates before deep diving into the strategic frameworks of NZDUSD. The pair is showing moderated IVs among G10 FX bloc (3m IVs are in between 7.20 - 8.15%).

IV factor is highly imperative in FX option dynamics because the option pricing significantly depends on future volatility, and it is quite impossible for any veteran to ascertain accurate future volatility.

The skewness of 3m IVs still signals extreme downside risks, bids for OTM put strikes are quite visible (up to 0.58 for these tenors, refer 2nd chart). Based on above-mentioned fundamental factors and OTC outlook, diagonal debit put spreads are advocated on RBNZ’s post monetary policy effects, the strategy is designed to mitigate the downside risks with a reduced cost of trading.

The execution: Short 1m (1.5%) OTM put option with positive theta (position seems good even if the underlying spot goes either sideways or spikes mildly), simultaneously, add long in 2 lots of delta long in 3m (1%) ITM -0.79 delta put options capitalizing on the minor upswings in the short-run.

Alternatively, we recommend short hedges staying shorts in NZDUSD futures contracts of May’20 delivery with a view of arresting bearish risks in the major trend. Courtesy: Sentry & JPM

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence