Among the three bearish drivers of FX in March economic fallout from COVID-19, oil price war and poor liquidity only one has abated (oil).

The weak fundamentals keep us cautious in FX. Growth forecasts are still getting downgraded, even though new infections have peaked in DM. FX markets remain asymmetric to vol shocks.

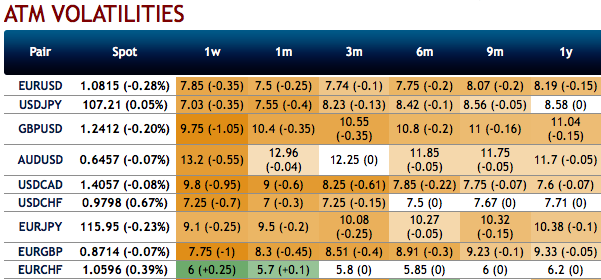

ATM IVs (implied volatilities) of G10 FX-bloc has again been dipping (refer above nutshell), the sharp reversal in the VXY in April series has left it screening 0.5 - 1.5 pts. cheap vs. cyclical correlates, which is hard to justify in a climate of worsening growth, elevated oil / commodity volatility and political tails risks in Europe and China.

GBP, Scandi FX downgraded as you could observe the negative bids for the existing bullish risk reversals, while euro crosses see upside hedging and CAD also sees upside hedging sentiments.

Mid-curve USDCAD vols screen cheap despite the dramatic sell-off in oil this week. Buy USD call/CAD put one-touch calendar spreads with premium rebate as a carry-positive, leveraged forward volatility play.

The increase in hawkish rhetoric of late out of the US around China in the context of COVID-19 risks another flare-up in US/China tensions. Buy low and flat CNH 6M6M forward volatility (FVA) as a hedge, which has the added benefit of offering pre- vs. post event exposure around the US elections in November. Courtesy: JPM & Saxo

China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis