Is the skepticism intensifying on the Japanese central bank with their inflation projections? It is reckoned that not even the Bank of Japan (BoJ) still truly believes that the inflation target of 2% will actually be reached in the foreseeable future. Even if it courageously insists that a positive “momentum” is maintained. Against this background, it surprises me in fact that the yen is trending weaker this morning after the central bank was once again forced to lower its inflation outlook. The only convincing argument for me would be that this means that the normalization of its monetary policy is, therefore, a long way off.

However, we see indications that the BoJ is increasingly eyeing rate hikes, regardless of inflation developments.

However, we realize that the market does not quite share this point of view and as a result, do not trade JPY considerably stronger quite yet.

We revise down the USDJPY targets by 3-4 yen across forecast horizon upon some unexpected developments; however, the base theme and the medium perspectives remain the same. The fresh targets are 112 in 1Q, 115 in 2Q, 112 in 3Q and 109 in 4Q.

We continue to expect USDJPY to rise in H1 of 2019 as we reckon that 1) Japanese outward investments will remain active if the global economy continues to grow and 2) a combination of wider US-Japan rate differential and deterioration in Japan’s trade balance will weigh on JPY. It is expected to be followed by a decline in USDJPY as late cycle stress plays out.

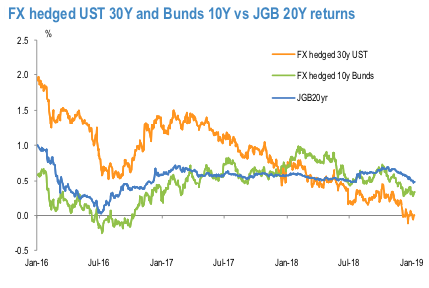

With respect to Japanese outward investments, Japanese investors might increase foreign bonds investments with no FX hedge. As shown in 1stchart, a rise in hedging costs has made foreign bonds investments with FX hedge less attractive compared to JGBs.

If such an environment persists, Japanese investors will possibly be more eager to take more FX risks.

Otherwise, we continue to foresee Japan’s FDI outflow to remain firm, especially if the global economy continues to expand, providing Japanese companies with attractive investment opportunities outside Japan. Our economists continue to expect the global economic growth to stay above the potential growth rate.

Furthermore, according to Bloomberg data, ¥17 trillion worth of cross-border M&A deals were announced during 2018, but only M&A deals with a total value of ¥3 trillion were actually completed. It is thus possible that the latent demand for yen selling related to FDI is substantial. Furthermore, the pace of M&A completion has picked up in November and December (refer 2ndhistogram chart), which might continue into 2019. Courtesy: JPM & Bloomberg

Currency Strength Index: FxWirePro's hourly JPY spot index is flashing at 15 levels (which is mildly neutral), while hourly USD spot index was at 41 (bullish) while articulating at (11:25 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons