GBP crosses are presently advanced by short covering and the recently improved PMI data resilient to the Brexit shock. But the second leg of weakness is due, as Article 50 has not been invoked yet and the BoE may cut rates again.

So we reckon the currency options are one of the best ways for corporations or individuals to hedge against adverse movements in exchange rates. The simplest types of currency options are: CALL and PUT. One of the attractions of options is that they can be used to create a very wide range of payoff patterns with leveraging impacts.

Execution of the Strategy: Option Straps

Rationale: Since, the pair has shown robust strength amid the major bear trend and is on verge of reversing the direction to the short term upswing minimum up to 139.155 level that is where it is deemed as a consolidation phase, as it is has bottomed out. Typically, we’re looking for a pennant within the context of an upward trend. For more reading on technicals, please refer below weblink:

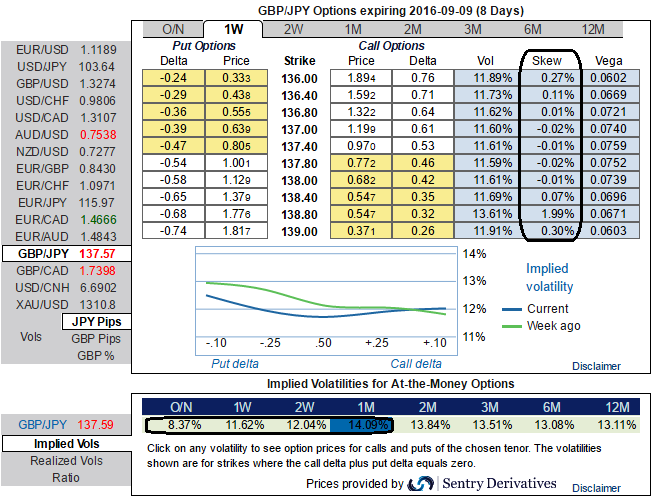

OTC Outlook: 1W and 2W ATM IV skews of GBPJPY cross are acting crazily in OTC markets, 1m IVs are flashing more than 14%. The skewness of implied volatilities are not certainly hinting any clarity in hedging sentiments but outwardly seems like slightly bullish bias in these tenors.

Please have a glance on how implied volatilities skews of ATM puts of 1w and 2W are positively correlated to both OTM as well as ITM strikes.

As a result, we recommend building the FX portfolio with longs positions in 2 lots of 2W ATM 0.51 delta calls and 1 lot of ATM -0.49 delta puts of 2W expiries.

Risk/Return Profile: Regardless of the swings the strategy is likely to derive positive cashflows with more potential on the higher side.

Whereas, the maximum loss for this strategy occurs only when the underlying spot FX price on expiration date is trading at the strike price of the call and put options purchased. Max Loss to the extent of net premium paid in addition to the commissions paid.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX