The acceleration in global growth towards 3% might even cause us to entertain the notion of adding some outright longs in cyclical currencies. What prevents us doing so is the caveat that these are not normal times politically speaking; in particular, we continue to believe that markets are overly complacent about the possibility of the President-elect acting on campaign pledges to address what it believes are unfair trade practices.

The Outlook discusses this issue in more detail, but the likelihood is that any action on trade following the inauguration would not sit easily with either risk markets or cyclical currencies.

Well, in our 2017 outlook, we included a number of protectionist hedges in G10 commodity currencies and we remain comfortable with both of these positions even though they are marginally in the red (short CAD/NOK in cash and short AUD/JPY through a 3Mx6M calendar spread of one-touch puts).

Stay long NOK vs EUR and CAD We continue to recommend NOK longs as an outright play on stronger oil prices and the ongoing improvement in the outlook for NOK rates (EUR/NOK) as well as an oil-neutral hedge to potential trade conflict under the incoming Trump Administration (CAD/NOK).

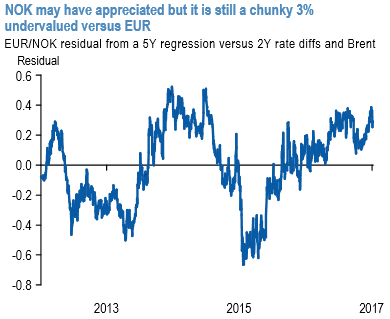

NOK is the second strongest performer in G10 since the last FXMWon December 16 (up 2.2% versus USD) yet it has plenty of headroom still to rally as it remains markedly undervalued relative to cyclical drivers.

Fair-value for EUR/NOK currently stands at 8.72; the resultant 3% undervaluation of NOK is amongst the more extreme of the last five years (this is a 1-sigma gap – refer above chart).

In addition, NOK TWI is 1.7% lower than the Norges Bank projects for Q1; hence there’s no suggestion the currency is close to levels that could start to undermine the interest rate outlook.

Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data