The Australian inflation data for Q2 provided a considerable dampener for the rate cut speculation this morning.

The inflation measure preferred by the Australian central bank (RBA), the trimmed mean, remained surprisingly stable at 1.7% YoY.

That means, at least on the inflation front the RBA does not see any urgent need for action. The rise of AUD since late May, on the other hand, is likely to be a reason for concerns for the central bank. That means the door has not been completely shut on a rate cut yet.

On the flip side, This week is a busy one for Japan data watchers with many June releases including CPI, housing starts, and FX markets digesting the better than forecasted trade balance data, while the key focus should be on Friday’s BoJ policy meeting.

If it is judged necessary for achieving the price stability target” (from June Statement on Monetary Policy). The economy has struggled with deflation for two decades. Even after the BOJ's massive qualitative and quantitative easing (QQE) program and venture into negative interest rates territory, the Asian economy hasn't been able to boost domestic consumption and shake off deflation.

Hedging Framework: Capitalize on rallies and HY vols likely to favour PRBS

AUDJPY has consistently been sliding in a sloping channel as selling momentum is intensified as the monetary policies adding extra impetus to the selling pressures, so the foreign traders who have their export or import bills should be hedged by below option strategies.

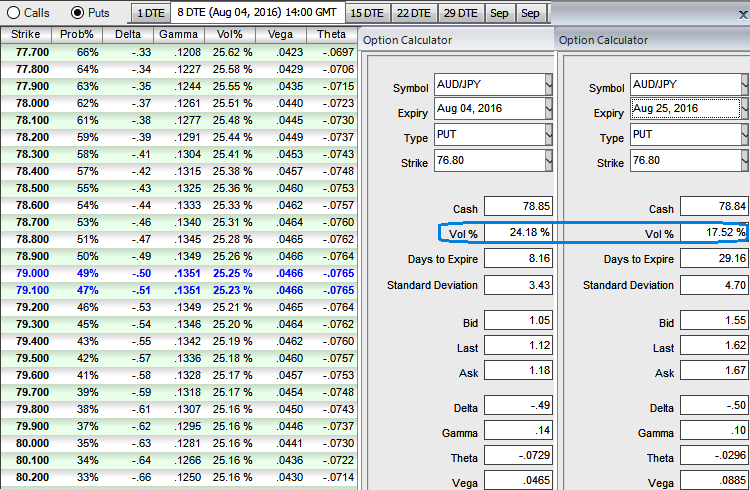

ATM IVs of 1w expiries are flashing at 24.18% and 17.52% for 1m tenor.

While IVs of ATM contracts of 1w and 1m tenors are spiking crazily and this has been justified by historical volatilities in spot FX fluctuations (see big real body candles on monthly technical charts).

Traders tend to view the put ratio back spread as a bear strategy because it employs puts. However, it is actually a volatility strategy. The implied volatility of 1M ATM put contract is at 17.52% and it is quite higher side when long-term trend is bearish.

Traders tend to view the put ratio back spread as a bear strategy because it employs puts. However, it is actually a volatility strategy.

Options with a higher IV cost more. This is intuitive due to the higher likelihood of the market 'swinging' in your favour.

As we expect the underlying currency exchange rate of AUDJPY to make a larger move on the downside. As shown in the figure purchase 1M 2 lots of At-The-Money -0.52 delta puts and sell 1W one lot of (1%) In-The-Money put option.

Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics