The long-awaited rebalancing of the global oil markets is at hand. Although oil inventories remain high globally, non-OPEC supply, led by declining US crude output, is falling. Based on this, as well as solid global demand, we anticipate slight global stock draws in H2 2016 and significantly bigger global stock draws next year.

We are cautious on the near-term price outlook due to downward pressure as crude returns from disruptions. However, we become more bullish as we progress through next year, when we forecast steadily increasing prices driven by global rebalancing.

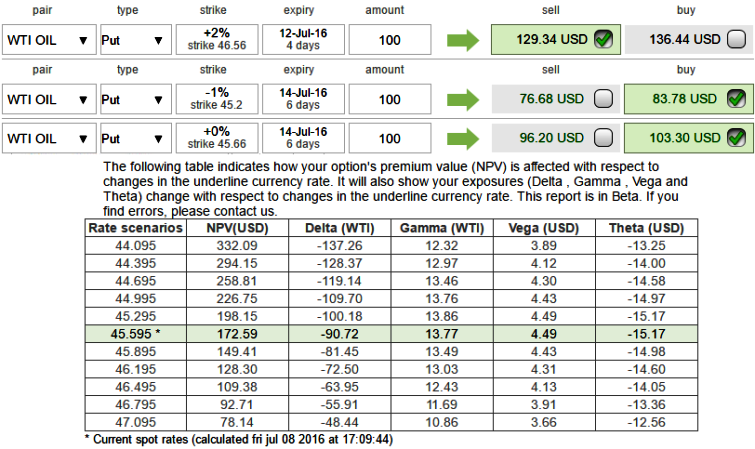

The WTI oil is currently trading at around $45.52; the hedger who is bearish on this commodity executes 2:1 put back-spread by initiating following trades.

Let’s just suppose hypothetical scenarios contemplating prevailing major downtrend of WTI crude.

Calling for 43.36 or below levels in medium run, and shorting a near month 4D (2%) in the money put for $129.34 and go long in 2 lots of the same near month contracts 1W (1%) In The Money & At the money delta puts for around $187.08.

So thereby the net debit would be reduced to enter the strategy and any potential downswings would be taken care by 2 lots of puts.

We can see the gamma difference at current spot reference, for dip in the underlying price of the commodity which means the rate of change of the Delta with respect to the movement of the rate in the underlying market. But it is even better if the dips occur after 4 days as we have a short position in the strategy.

In the Sensitivity table, Gamma shows how much the Delta will change if the underlying rate moves by 1%.

A smaller Gamma means the Delta is less likely to change as the underlying market moves.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed