On-going euro turbulence: The main risks events are now in Europe (ECB in September, Italian referendum, immigration tensions) and in the US (Jackson Hole, presidential election): this should support EUR/USD volatility.

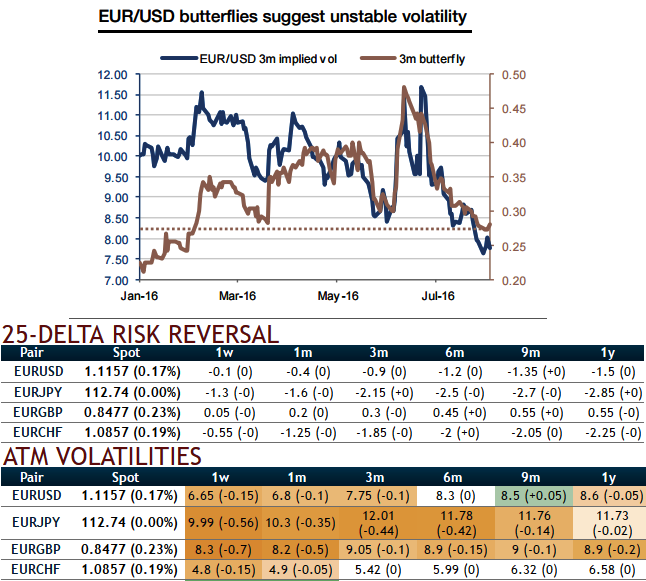

As the delta risk reversals of euro crosses have again shown in bearish interests as the progressive increase in negative numbers signify the traction for hedging sentiments for further downside risks in both short and long term.

Italy’s upcoming referendum on constitutional reform is not akin to Brexit, Prime Minister Matteo Renzi said in an interview on Monday.

Italy has its own referendum coming up in October, one which premier Matteo Renzi has staked his leadership on. But why might this vote have a worse impact on the EU than Brexit?

Although it’s more relevant to political aspect, much like Brexit in the UK, the referendum is increasingly being seen as a way for Italians to air their general discontent with the establishment, in large part because Renzi swore that he would leave politics if the referendum did not go his way. If he loses his gamble, the results of the referendum could have vast consequences for Italy and the whole of Europe that in turn adds extra risks to the euro in long run.

While, the 3m vol has broken its lows to reach 2014 levels, but interestingly butterflies have not even fallen to the 2016 lows (see graph and nutshell showing RR & IVs). EURUSD IVs are substantiating the swings so as to suitable for butterfly spreads.

The smile suggests that the options market expects some volatility instability, which means unexpected spot deviations.

Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures