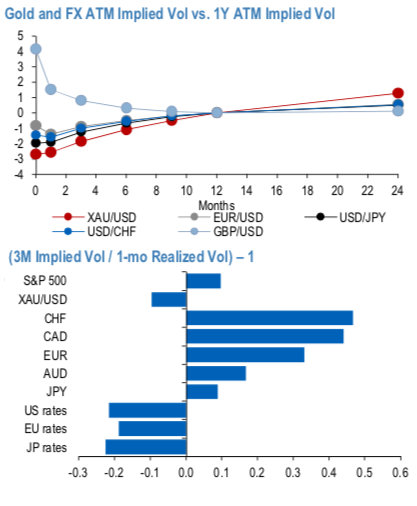

Gold vols: The positively skewed IVs of 3m gold contracts (XAUUSD) are still indicating the upside risks and 1m implied volatility is spiking above 8.2%.

With the wages print that came in soft in last Friday’s US jobs report, gold realized vol should remain contained. The US unemployment rate came in at 3.8 percent in March 2019, unchanged from the previous month's figure and in line with market expectations. The number of unemployed persons decreased by 24 thousand to 6.2 million while employment dropped by 201 thousand to 156.7 million.

The returns on gold vol trading have been mediocre and quick to reverse in recent weeks.

Our gamma trading model continues to indicate gold gamma to be a sell but at a lower conviction. Front-end spot-vol correlation underperformance weighed on risk reversals, which are back to nominal levels.

Meanwhile, the back-end riskies continue to look rich vs. the ATM vols, moving the needle in the direction of long expiry call spreads. 1Y ATMF/25D XAUUSD call spread shows 3.8X max payout to cost ratio and comes at a 41% discount to outright vanilla.

Notably, 3M silver vol is 2 sigma cheap (1yr basis) though the 1 vol rolldown is putting further downside pressure. We are watching it as an RV vs gold for more favorable net vol carry entry levels. Courtesy: JPM, Sentrix & Saxo

Currency Strength Index: FxWirePro's hourly EUR spot index is flashing 72 (which is bullish), while the hourly USD spot index was at -32 levels (mildly bearish) at 12:08 GMT.

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data