Fed is scheduled to announce funds rates decision tomorrow, and we’ve already stated in our previous post that the Federal Reserve is no longer expected to pause the rate hike cycle early next year for two main reasons. Primarily, the nomination of Governor Powell as the next Fed chair, in our view, represents a vote for continuity of policy. Secondarily, the unemployment rate is falling again. At 4.1 percent, the risk of a substantial undershoot is rising, Barclays Research reported.

Elsewhere, the BoJ is consensually seen as the last bank to embrace normalization. When the market sees the slightest hope that the central bank is done with monetary easing, this will likely trigger very asymmetric yen risk. After the euro’s convergence to its valuation, a sudden yen spike should be the second stage of the dollar fall. USDJPY has the particular capacity to evolve in a succession of fast trends and prolonged range-bound phases. With this in mind, the USDJPY risk is a return to the 100-105 area once the BoJ brings an end to the current consolidation.

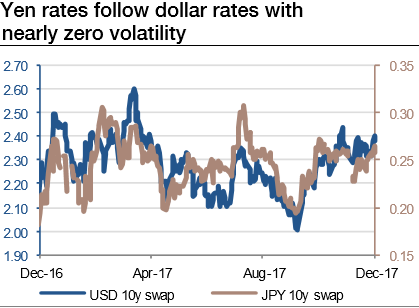

Since the Japanese central bank thrived in killing yen volatility, USDJPY has been a proxy of dollar rates. Japanese long-term rates are following US rates, but have shown almost zero volatility for a year now (refer above graph). USDJPY is thus coincidentally positively correlated with JPY rates.

But for now, majorly what matters most to the FX market next week is how the FOMC members judge the inflation development that is likely to cause volatility in the FX bloc. In the process, the dots, which reflect the individual member’s rate expectations, might be revised slightly to the downside in the long end as many FOMC members have become more doubtful about a sustainable rise in inflation over the past weeks and months.

That, in turn, would confirm the market in its view that the Fed will not hike interest rates as often as it is signaling next year and will put pressure on the dollar. This Fed rate hike today, on the other hand, is almost entirely priced in and is therefore unlikely to have a significant effect on USD.

The correlation of the USDJPY with bond yields is well-known. A gentle uptrend in Treasury yields, anchored JGBP yields, and a stronger EURUSD is a recipe for the USDJPY to rise a bit, and the EURJPY to rally by more. The danger though is that overpriced global asset markets cannot cope with more than a very mild rise in US yields and that it’s only a matter of time before an aging US economic cycle rolls over. When that happens, we may find both that the Fed’s next move is to ease policy and that risk assets get little help from lower yields. At that point, the yen likely will rally sharply.

Currency Strength Index: FxWirePro's hourly USD spot index is inching towards 22 levels (which is neutral). While hourly JPY spot index was at shy above 59 (bullish) while articulating (at 07:03 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes