After last week’s spikes above 21DMA in EURJPY (last week’s highs of 116.280 levels), don’t you think EURJPY at inflexion point?

USDJPY and EURUSD could rise at the same time, triggering a EURJPY topside break towards 120.

EURJPY reconnected with gold prices when the BoJ set negative rates, but now lags the gold break below 1300, despite yen unwind.

If ECB tapering were to be confirmed, expectations of higher Bund yields would strongly lift euro crosses.

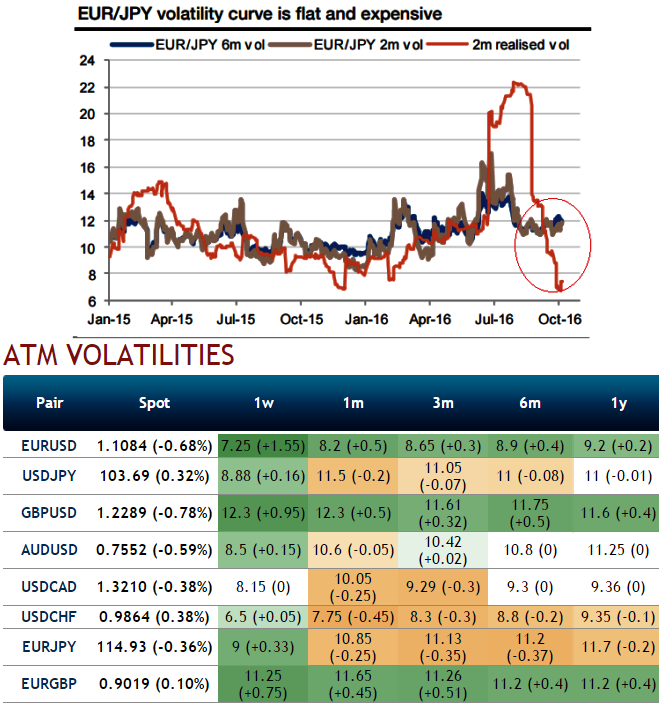

From the expensive EURJPY volatility, the expectation of a gradual bullish move in EURJPY is lingering, which is convenient since the option market prices less topside than downside volatility.

Being short volatility is also an attractive proposition since the implied curve is relatively flat and more elevated than realised volatility, which fell to very low levels.

The 2m realised volatility is below 8 while the implied curve is trading above 11.

A bullish spot move would reduce the excessive volatility risk premium, suggesting short vega/gamma structures.

Last week, we appropriately called the USDJPY topside break, consequently, the pair has jumped above 21DMA (last week highs at 104.163) and for now, get ready for the sustenance above.

Among other factors, we argued that the market was exceptionally long yen, but even when these positions are cleaned, the move will not be harmless and could be the start of a trend of much greater amplitude.

The EURJPY has not broken yet and we are now pointing to the pair’s upside risks. In our stances, the recovery should persist towards a multi-month descending trend at 116.40/90 and even to 121.50/122.50 the medium run.

We continue to expect the euro to tick higher into 2017 despite Fed tightening, particularly given the ECB's misgivings about its QE programme. The forecast profile is little changed from the trajectory, the proposed EURJPY forecasts are as follows - Q4 118, Q1 2017 119, Q2 2017 120 and Q3 2017 121.

Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One