This has been a year of lower vols, especially among FX space. Just glance at the OTC FX markets, shrinking implied volatilities (IVs) are luring options writers. Please observe USDCHF, EURCHF, and GBPCHF are showing lower IVs despite the schedule of SNB’s monetary policy event for this week.

This may be because the Swiss National Bank (SNB’s) has been maintaining the status quo in its monetary policy to leave everything unchanged (kept libor rate at -0.75%). Consequently, the development of CHF over the past weeks did not seem to have provided any reason to tighten the monetary policy reins after all. With lingering uncertainty over the Italian budget conflict and Brexit, CHF seems to be much more in demand again recently. During such a circumstance that the SNB does not want to give the FX market any other arguments for trading the franc at stronger levels, which would put pressure on the inflation outlook and domestic exports.

The medium-term fundamental factors which support CHF are still intact in our opinion, even if they comprise relatively slow-moving, structural forces which may not be observable day to day. Chief amongst these is Switzerland’s structural balance of payments disequilibrium, by which we mean the combination of an excessive current account surplus and inadequate private sector capital outflows to recycle the surplus. This disequilibrium has become more acute over the past year resulting in upside pressure on the franc.

Please be noted that EURCHF’s major downtrend remains intact (refer above chart), technically, although you see some mild rallies in the short run, downswings are likely to extend after sliding below 21EMA on the occurrence of bearish engulfing pattern, both trend & momentum oscillators on the bearish bias.

OTC updates and trade recommendations: (Short in EURCHF via ITM put options, spot reference: 1.1204 levels).

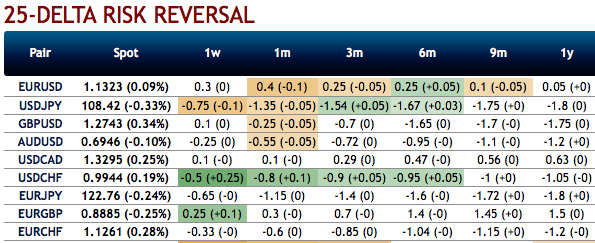

EURCHF bearish neutral risk reversal numbers and positively skewed of implied volatilities of 3m tenors signify the bearish risks to prevail further (refer 1stand 2ndexhibits). 25-delta risk reversals indicate the difference in volatility, and therefore price, between puts and calls on the most liquid out-of-the-money (OTM) options quoted on the OTC market. Negative bids indicate puts are more expensive than calls (downside protection is relatively more expensive).

Accordingly, we advocate 2m (1%) in the money -0.79 delta put options, the rationale for choosing such derivative instrument is that the in the money put with a strong delta would move in tandem with the underlying downward moves. Courtesy: Sentrix, Saxo & JPM

Currency Strength Index: FxWirePro's hourly EUR spot index is inching towards -23 levels (which is mildly bearish), while hourly CHF spot index was at 26 (mildly bullish) while articulating (at 11:54 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms