A disintegration of the global trade order is the one thing that does not seem to be on the cards right now. But the sanctions against Turkey (a NATO ally), threats of “painful” tariffs against China made by Trump’s trade policy Grand Inquisitor Wilbur Ross and threats of “crushing” sanctions against Russia made by the US Congress – the US are obviously not trying to make friends in the world right now.

Even if US demand declines, strong emerging markets may become better integrated into global supply chains – to the advantage of all, except the US, of course. This may make (sometimes painful) adjustments necessary. It is therefore understandable that EM currencies are currently under pressure. However, there is no reason to expect an EM crisis from a fundamental vantage point.

Contrary to that, the latest pact between Trump and Juncker on car tariffs could help to ease global trade war tensions and act as a powerful catalyst for improving market sentiment towards EM currencies.

As G10 FX vols have been disastrous to exhibit clarity in directions over recent months, EM vols have been on a steady rising mode since mid-March, which has brought the average EMG10 spread to the highest level since 2009.

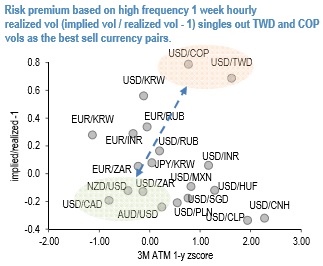

Here, we focus on an RV structure which could benefit from the wide Carry embedded in EM vols and by tightening EM-G10 vol spread. When looking for attractive L/S trades in vols, a 2-d dislocation vs vol premium analysis offers a helping hand for detecting interesting pairs (refer above chart).

At present, if we focus on the EM space, two currencies stand out as attractive for selling vol: COP and TWD. TWD had been already identified as an interesting candidate where to sell vol, against USDSGD, in a previous note, despite its general features of low vol / low beta in the Asian space. The rationale behind the former RV trade, a combination of positive vol Carry combined with modest exposure to risk, is still valid. Courtesy: JPM

Let’s glance at the FxWirePro’s Currency Strength Index ahead of today’s US non-farm employment data: FxWirePro's hourly USD spot index is struggling at 42 (which is bullish), hourly EUR spot index was at a tad below -14 (neutral), while hourly JPY is flashing 28 (mildly bullish) while articulating at 11:08 GMT. For more details on the index, please refer below weblink:

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation