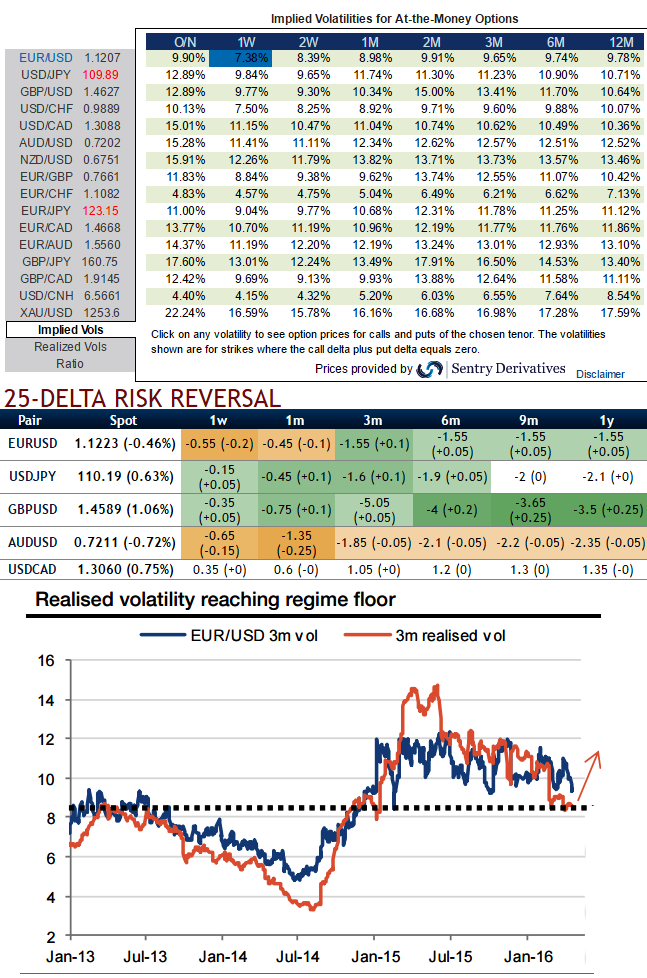

EUR/USD volatility is trading close to its lowest level since the start of 2015, current ATM IVs are at 9.9%, likely to reduce to 7.38% in 1W expiries.

But, implied volatility is probably at the floor of a persistent and stable high-volatility regime, suggesting a substantial likelihood of mean-reversion towards higher levels.

Volatility more predicable within its range, in a regime of high and stable volatility, implied volatility has been strictly range-bound at relatively high levels for more than a year. If the stability persists, volatility will become more predicable within its range.

We get more insight in running a three-state Markov switching model on 3m implied volatility since the start of 2010.

In this framework the regimes persist over time, and switches thus announce significant turning points in market dynamics. It turns out that the model switched into a high-vol regime when the range-bound period started and that this regime still prevails. Therefore, the current regime may encapsulate both the volatility level and its stability.

Bounce in realised volatility is most likely upon event risks:

The 3m realised volatility is approaching 8. It now seems at a threshold between two price-action regimes. With the spot returning towards the middle of its range, it is now unlikely that volatility will experience a regime switch.

The odds favour a bounce in realised volatility, as the spot should remain turbulent. The 3m tenor includes the 2 June ECB meeting, the 15 June Fed meeting and the 23 June UK vote.

Hence, we believe these rising vols can play a vital role in option holders for sure especially in 2m & 3m tenors, longs in any hedging strategies are advisable, more proportions in hedging positions would fetch desired outcomes.

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data