CAD has continued to exhibit resilience despite a number of ups and downs in the global macro landscape in the second half of this year. For now, it is quite important where things are going as far as the Bank of Canada (BoC) is concerned. And what matters most to the BoC is how the trade conflict between China and the US develops.

As things seem to be calming down on that front, even if no far-reaching deal is reached, the BoC is unlikely to see any reason at its next meeting at the end of October to abandon its cautiously neutral approach or to significantly adjust it inflation and economic forecast in its new Monetary Policy Report.

As long as the trade conflict does not put the brakes on to the economy and inflation the BoC will wait and see before changing its stance, which is likely to support CAD; in particular as the Fed is likely to continue cutting its key rate.

USDCAD has been dipping from the recent peaks of 1.3345 levels to the current 1.3063 levels, the major robust uptrend seems to be exhausted for now. Thus, we reckon this as ideal time to deploy OTM call shorts and recommend below options strategy with an objective of utilizing these price dips.

Over that time, CAD trade weighted returns narrowly trail that of only JPY, CHF and USD – traditional anti-cyclical, safe-haven currencies that have benefited from significant flare-ups in the trade war.

Hence, it is wise to capitalize on USDCAD Interim Dips, and bid short-tenured risk reversals and 3m IVs to optimize hedging strategies.

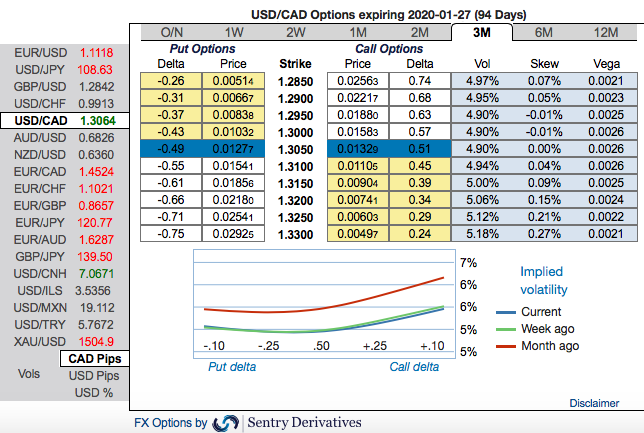

Options Trades Recommendation: At spot reference: 1.3063 level while articulating, we advocate diagonal debit call options spreads foreseeing both downswings continuation in the near-terms and the major uptrend.

OTC Outlook: The positively skewed IVs of 3m tenors are also indicating both downside and the upside risks.

While bullish neutral risk reversal numbers substantiate this bullish stance, positive RRs are indicating the hedging setup for the upside risks.

The Execution: USDCAD 3m/1w call spread strategy (strikes 1.29/1.32) for a net debit.

The rationale: Firstly, as you could observe the underlying spot of USDCAD has dipped somewhat in the minor trend below 1.30 level with exhausted bullish sentiments from recent past or so, hedgers’ interests remained intact onto the bullish neutral risk reversals in longer tenors along with shrinking IVs (implied volatilities).

Short calls are most likely to expire worthless, so that the option writer can be rest assured with the initial premiums received.

Secondly, One should understand the prime intricacy of choosing ITM call which is that such options with strike prices close to the price of the underlying spot tend to have the highest risk premium or time-value built into the option prices. This is compared to deep in the money options that have very little risk premium or time-value built into the option price.

Thereby, one can achieve hedging objective as the deep in the money call option with a very strong delta will move in tandem with the underlying spikes.

Favour optionality to directional trades. We are inclined to position for a directional call spreads, as calling the bottom is quite difficult and adding naked spot exposure is risky at the moment.

Maintain the net delta of the position above 70% as shown in the above nutshell and shorting the upper leg call (OTM strikes) likely to reduce the cost of the ITM call by almost close to 20-25% as you could see skews of 2w tenors are well-balanced on either side. Source: Sentrix, JPM & Saxobank

2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure