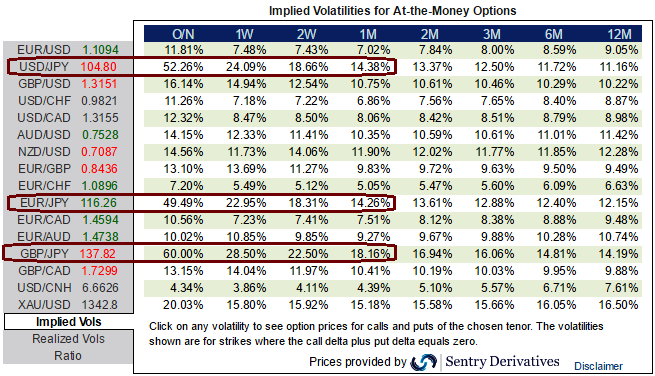

Please have a glance IVs of Yen crosses (see highlighted portion of yen crosses), 1W ATM tenors have spiked above 22% almost all yen crosses, and this turbulence in OTC market is majorly due to tomorrow’s monetary policy decision by BoJ.

This week is a busy one for Japan data watchers with many June releases including CPI, housing starts, and FX markets digesting the better than forecasted trade balance data, while the key focus should be on Friday’s BoJ policy meeting.

A successful option strategy generates decent leverage while controlling risks. Different structures will produce various risk reward profiles. A central idea behind the risk reward notion is that for a given market scenario, the cheapest strategy will not necessarily be the most profitable. Indeed, the leverage of a strategy is a more pertinent decisional parameter than its cost.

As you know that if IVs increase and you are holding an option, this is a good news for them and you should also note short-dated options are less sensitive to IV, while long-dated are more sensitive.

Well, in above highly volatile case Yen crosses the leverage of a given strategy cannot be a single number but is a full leverage profile. This metric not perfect, as the maximum leverage is finite only for strategies with a capped profit but infinite for single vanillas (unlimited gain) and zero cost strategies (no premium). It is, however, suitable for our purpose of comparing strategies.

The easiest way to define the leverage is to divide the strategy payoff by its cost, based on the spot level at expiry. The obtained function relates the strategy leverage to all terminal spots.

With a clear slowing in the inflation trend and inflation expectations among both corporates and households, and Brexit, we find it hard to imagine whether the BoJ would ease this week or not, given its frequent statement “the central bank would observe risks to economic activity and prices, and take easing measures in terms of three dimensions—quantity, quality, and the interest rate.

If it is judged necessary for achieving the price stability target” (from June Statement on Monetary Policy). The economy has struggled with deflation for two decades. Even after the BOJ's massive qualitative and quantitative easing (QQE) program and venture into negative interest rates territory, the Asian economy hasn't been able to boost domestic consumption and shake off deflation.

Indeed, according to the Japan Center of Economic Research, 86% of 42 economists surveyed between June 27 and July 4 expect policy easing on Friday. No action by the BoJ would erode its credibility on achieving the inflation target and tighten monetary conditions through JPY appreciation.

Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential