We head into the ECB with prices still within 1.1820 support and the 1.1980 reactions high from last week, currently, gaining upside traction with prevailing spot price at 1.1976 levels. We consider that the 1.20-1.23 area will cap this year’s rally for a correction back towards 1.16-1.15 support. A move through 1.1980 would suggest another test into the upper resistance region, while a break of 1.1820 and then more important trend support at 1.1770/55 would confirm the broader correction is underway.

Well, after all, it seems puzzling whether levels well above 1.20 for EURUSD and 0.9306 for EURGBP might be too much for ECB President Mario Draghi and his colleagues on the ECB council. Despite the fact that European central bank is not inattentive by one pip more or less if it is concerned about appreciation or depreciation and the possible effect on inflation.

Before the ECB, Eurostat is expected to confirm the Eurozone economy expanded by 0.6%q/q in Q2, which is higher than the ECB’s forecast of 0.5%q/q in its June projections. With the broadening of the economic recovery and diminished deflation risks in the Eurozone, policymakers may have started to discuss the orientation and detail of future stimulus measures beyond the end of this year.

It is the general trend they worry about. And the trend no doubt does not suit the ECB leaders, as the last ECB minutes made clear. That means we can expect to hear comments on the development of the currency at next week’s ECB meeting.

However, these are less likely to run along the lines of “the euro is too strong” and more along the lines of “we closely monitoring the exchange rate” (as in 2014). The higher the euro rises or rose in the run-up to the meeting the higher the likelihood of such a statement being made. In particular as the ECB will now have to notably raise its exchange rate forecast.

In long term perspectives, we believe EURUSD’s 1.0350 was a major low, which completed the cycle from the 1.60 2008 highs. As such, we look for an eventual move back to the main medium-term resistance region between 1.2000 and 1.2350, while long-term targets lie in the 1.30-1.35 zone.

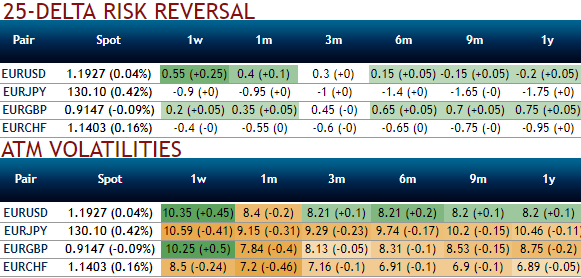

Contemplating all these factors, OTC markets have factored-in, please be noted that the implied vols, as well as risk reversals of euro crosses, have been considerably spiking higher ahead of ECB’s monetary policy decision. Positive RRs and positively skewed IVs would imply the euro’s strength. Vol pts Positive smile theta participation in Euro bull-trend.

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed