The main attraction today will be the ECB policy decision followed by Draghi’s press conference. The brighter economic outlook in the Eurozone has already resulted in an upward revision to the ECB’s assessment for growth to "broadly balanced", while its explicit reference to potentially "lower" interest rates was removed. The market is now looking for further amendments, including the dropping of its easing bias within its asset purchase guidance.

For EUR, there are risks in both directions today, although the options market break even suggests we could be constrained to a relatively tight range.

On a trade-weighted basis, the EUR has appreciated by less than 3% since the beginning of May. As per the Commerzbank factor model, it confirms that the EURUSD rise in the past three months is mainly due to USD weakness and to investors’ increased risk appetite, not as much to EUR strength. Therefore, the ECB will probably not necessarily aim to weaken the EUR, but only to prevent a further appreciation. Against this background, Draghi might start a program of verbal interventions against the EUR today by talking more about the exchange rate – similar to his strategy in spring 2014, when EURUSD traded near 1.40. Back then, Draghi spoke extensively about the importance of the EUR exchange rate for the inflation outlook and hinted that the ECB might possibly loosen its monetary policy in order to weaken the EUR. Later on, the ECB even mentioned the exchange rate in its press release.

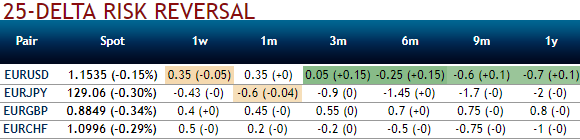

OTC hedging sentiments for euro crosses have been indicating upside risks except for EURJPY. You could see positive hedging bids for EURUSD, EURGBP and EURCHF in 1m risk reversals are evidencing the hedging interests for upside risks (while articulating). Hence, even the underlying pair keeps moving in sync with the OTC indications.

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures