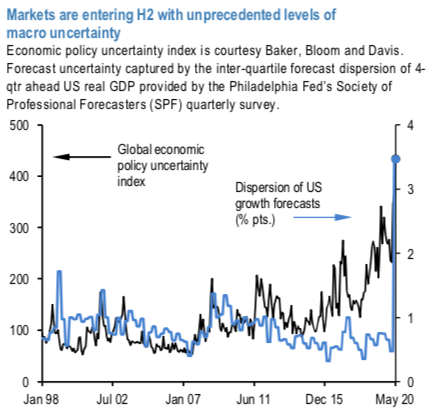

Markets are entering 2H’20 with unprecedented levels of economic uncertainty thanks to the havoc wreaked by Covid-19. Visibility on forward looking macro outcomes as captured by the dispersion of growth projections in the Philly Fed's SPF survey is the poorest on record (refer 1st chart); the same applies to virtually every activity variable in the forecast panel. Severe unpredictability around the virus’ trajectory, regional and global variation in administrative responses to second wave outbreaks (full, partial or no lockdown 2.0), question marks around the ability and willingness of fiscal authorities globally to roll over emergency fiscal measures instituted at the height of pandemic pandemonium in Q1, the inherent unknowable around the fate of vaccine research, and medium term questions around the extent to which investors will continue to give a free pass to extraordinary fiscal expansion even in EMs where public finances are fraying leaves open a wide range of market outcomes in coming months such that confidence intervals around modal views are abnormally wide.

Economic uncertainty is likely to be compounded by political uncertainty as US election campaigning reaches a crescendo. The Trump upset of 2016 was arguably the pivotal political event of the decade whose multi-faceted global fallout continues to be acutely felt to this day. A blue wave in 2020, if it were to materialize, could prove comparably market moving should US equities swiftly discount a less corporate-friendly Democratic tax and regulatory agenda. The voting process itself could prove to be a bone of contention given the sharp political divide on the issue of mail-in ballots, and the possibility of a stalemate on election night cannot be ruled out. The heat of election rhetoric could also intensify US/China tensions, especially as peak campaign season in the US overlaps with Hong Kong’s Legislative Council elections in September, against the backdrop of the contentious new security law.

Yet FX option markets appear oblivious to this unusually high degree of unpredictability. On our workhorse cyclical model of FX vol, current levels of VXY screen 4 pts+ too low (~ -3-sigma misalignment – refer 2ndchart). We caution against taking this massive undershoot at face value however, since much of it is driven by recessionary levels of PMI and abnormally elevated forecast uncertainty around key economic variables such growth, inflation and unemployment as flagged earlier, both of which should normalize in coming months as economies reopen from lockdowns and visibility on Covid damage improves. Also, the disconnect between manifestly poor macro conditions and unfazed asset markets is hardly a FX vol-specific phenomenon; if core asset markets in the eye of the storm such as equities and credit can remain persistently misaligned vis-à-vis growth / default risk fundamentals thanks to Fed intervention, currency vol can hardly be expected to be the ground zero for a major macro vs. market realignment. At a minimum though, the vol vs. macro set- up suggests that a high degree of caution is warranted around short volatility trades, since the outsized fear premium of 1Q’20 has long become history. Not to mention that sub-par liquidity in these challenging market conditions raises the bar for short risk premium trade constructs. Courtesy: JPM

2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One