Market participants entering the FX OTC derivative market are confronted with the fact that the volatility smile is usually not directly observable in the market. The degree of moneyness of an option can be represented by the strike or any linear or non-linear transformation of the strike (forward-moneyness, log-moneyness, delta). The implied volatility as a function of moneyness for a fixed time to maturity is generally referred to as the smile.

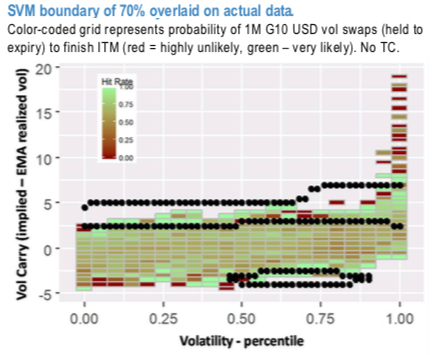

A framework based on machine learning techniques has been utilized in long/short FX vol trade discovery process. It exploits two cornerstones of gamma trading: implied volatility pricing (which accounts for vol mean reversion propensity) and implied-realized volatility spread (a proxy for the expected carry) in order to discover which implied vol and vol carry combinations lead to favourable vol buying/selling opportunities.

1M volatility selling P/L hit rate is represented as color-coded cells in the Percentiles (implied vol) - Vol carry grid in 1stchart with the dotted black line demarking the machine learning model implied regions of favourable vol selling (the island on the bottom and the stripe across). SVM (support vector machine), a supervised machine learning model, was used to model the 1stchart non-linear decision boundary.

With individual G10 currency SVM models in hand we rank USD/G10 vols based on estimate of success in vol shorting (refer 2ndchart).

The latest leg of Italian political risk re-emergence brought back investors’ interest in hedging the exposure. With USDCHF stuck in a slow gear one could viably consider tactically owning EURUSD vols financed by selling delta hedged OTM USDCHF calls amid elevated risk reversals (near zero cost) and the convexity profile that provides some protection in event of a CHF spike.

Alternatively, one could take advantage of the RV and construct a conditional EUR directional hedge: buy 2M EURUSD ATM puts vs. sell USDCHF ATM calls @20bp USD (@1.1/1.3 vols, spot ref EURUSD @1.1456 and USDCHF @0.9945), not delta-hedged. Our analysts expect modest CHF appreciation under low global vol conditions and a possible sharp rally in the event of intensification of political temperature in Italy. Both scenarios should leave short USDCHF call OTM. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly USD spot index is inching towards -86 levels (which is bearish), while hourly USD spot index was at 35 (bullish) while articulating (at 10:35 GMT). For more details on the index, please refer below weblink:

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025