Gold spot is struggling to break and sustain above the resistance at 1275 levels again despite CFDs have been drifting up with a safe haven sentiments, or on the Comex division of the NYME, gold futures contracts for June delivery were up 0.35% at $1,275.80.

Yellow metal is highly receptive to shifts in U.S. rates, as a rise would lift the opportunity cost of holding non-yielding assets such as bullion.

A steady lane to higher rates is perceived as less of a threat to gold prices than a rapid series of increases.

Hedging Mechanism & OTC Observation:

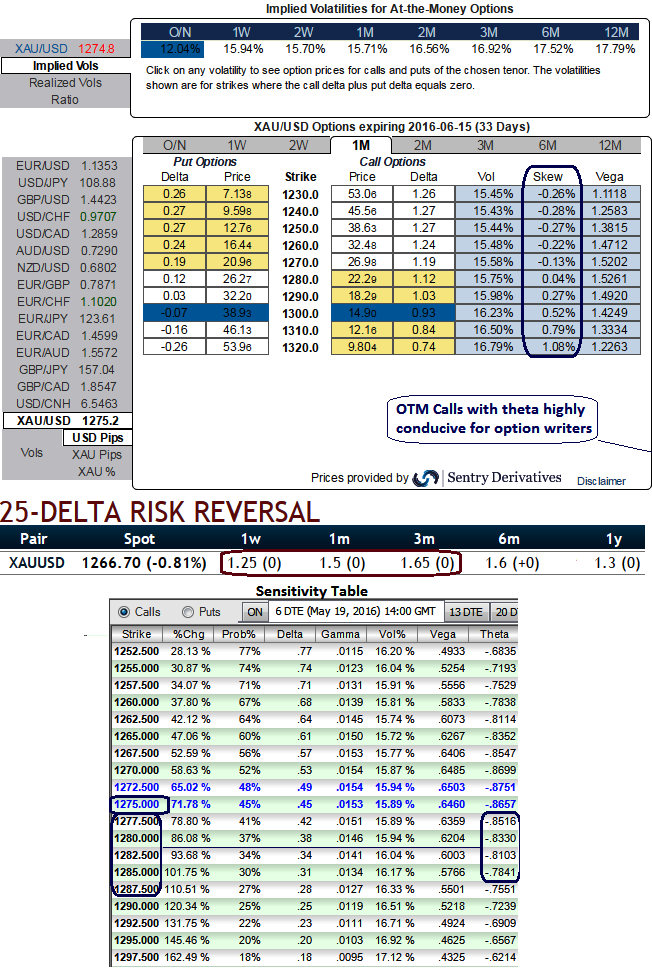

The implied volatility of 1W XAU/USD ATM contracts 15.94% and 15.71% for 1M tenors, cheers..! Good news for writers.

The skew appears negligible compared to the volatility, strongly suggesting spread with OTM strikes-like structures, conducive for writers.

Please be informed that the highest theta numbers on OTM call strikes, thereby, the writer of option most unlikely to be obligated for option exercise.

For ITM and OTM options as time to expiry draws nearer, Theta lowers and decreases. The above sensitivity table is an instance as to how Theta responds when the option is ITM, ATM, and OTM, and as time passes. You can also observe the dramatic impact of time decay (Theta) for an ATM option approaching expiry.

How to execute:

3-Way Options straddle versus Call

Spread ratio: (Long 1: Long 1: Short 1)

Rationale: Eying on favourable theta shifts considering lower skew and shorting expensive calls with shorter expiries. As a result, we capitalize on beneficial instruments to reduce hedging cost.

How to execute:

Go long in XAU/USD 2M at the money -0.49 delta put, go long 4M at the money +0.51 delta call and simultaneously, short 1M (1%) out of the money call with positive theta.

The dollar's recent rapid slide has been accompanied by a constant backdrop of dovish cooing from the Fed. Until this week, both equity and commodity markets had embraced the weak dollar as the elixir to solve all their ills.

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation