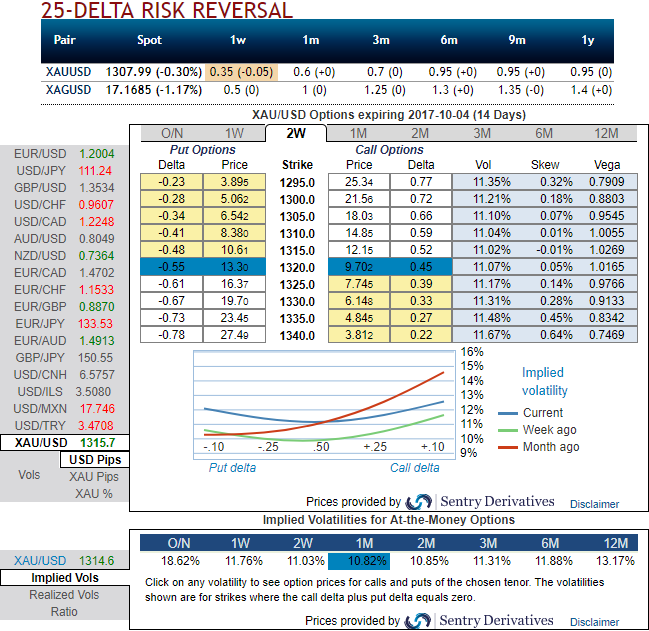

The implied volatility of 1m XAUUSD ATM contracts is a tad below 11%, (10.82% to be precise), while the skews in these IVs signify the hedging sentiment through OTC market has been well balanced for both bullish and bearish risks ahead of Fed’s funds decision.

While, bullish neutral risk reversals of lengthier tenors continue signalling upside risks, whereas 1w RRs indicate risk sentiments have turned onto bearish targets. Considering fundamental developments in bullion markets we think the opportunity lies in writing an expensive OTM call while formulating below strategy for gold's fluctuation at this juncture.

3-Way Options straddle versus calls

Spread ratio: (Long 1: Long 1: Short 1)

Rationale: Bidding 1m risk reversals match the IV skews.

As stated above bullion market sentiments remain safe-haven demand in long run especially after the delayed FOMC hikes (Fed unlikely to raise in this meeting) but quite possible 3 hikes in 2018.

We reiterate the negative risk reversals indicate mounting hedging sentiments for the bearish risks in 1 week, while fairly balanced IV skews that keeps us eye on shorting expensive calls with shorter expiries. As a result, we capitalize on such beneficial instruments and deploy in our strategy.

How to execute:

Go long in XAUUSD 1M At the money -0.49 delta put,

Go long 1M at the money +0.51 delta call and,

Simultaneously, Short 2w (1%) out of the money put with positive theta.

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes