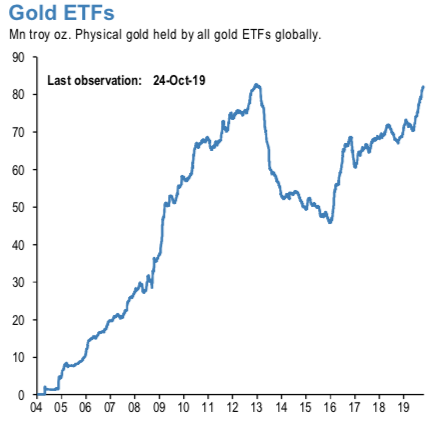

The safe-haven or investor demand for gold has been considerably mounting during 2019, the appetite for the precious yellow metal is growing as the amount of gold held by gold-backed ETFs hit a record high in the recent times (refer 1st chart).

Gold’s (XAUUSD) price has reclaimed $1,500 mark as the major uptrend resumed but the rallies appear to have been exhausted at the stiff resistance of 1518 levels as it continued the range bounded swings in the minor trend. It has surged almost more 17% so far in this year.

Simultaneously, the positive skewness of options contracts of gold implies more demand for calls than puts (2nd chart).

It can, therefore, be seen as an indicator of risk perception in that a highly negative skew in equities is indicative of a bearish view. The chart shows z-score of the skew, i.e. the skew minus a rolling 2-year avg skew divided by a rolling two-year standard deviation of the skew. A negative skew on iTraxx Main means investors favor buying protection, i.e. a short risk position. A positive skew for the Bund reflects a long duration view, also a short risk position.

Please be noted that the positively skewed IVs of 3m XAUUSD contracts are still indicating the upside risks (1st nutshell). One could see bullish risk reversal setup. To substantiate the above-mentioned dubious bullish sentiment, risk reversal (RRs) numbers indicate overall bullish environment (2nd nutshell).

The above risk reversal numbers have been known as a gauge of gold’s underlying market for bullish opportunities. Well, we know that options are predominantly meant for hedging a probable risk event in future.

Gold ETFs: While Gold ETFs retracement to previous highs could potentially boost gold price by around $100/oz. In the sixteen years since the launch of the first gold exchange traded product, gold ETFs have transformed the gold investment market. They have reduced the cost of ownership, increased efficiencies and provided added liquidity and access. It is a well-established investment vehicle with 110 gold ETFs available presently. Collectively, they held about 2,600 tonnes of gold, worth a value of $120 billion. With assets under management at this level, total gold ETFs now rival some major central banks in holdings, falling just behind the US, Germany and the IMF but ahead of Italy and France. Presently, gold-backed exchange-traded products are also well-diversified regionally. While the US and Europe account for the lion’s share of assets under management, ETFs in Asia have grown, too.

Trading and Hedging Strategy:

Capitalizing on any abrupt dips in the gold price in the short-run and OTC indications, bullish neutral risk reversals of gold, we advocate longs in gold via ITM call options as they look to be the best suitable at this juncture.

Buy 3m XAUUSD (1%) ITM -0.69 delta calls on hedging grounds. If expiry is not near, delta movement wouldn’t be 1-point increase with 1 pip in the underlying movement, which means if the spot moves 1 pip, depending on the strike price of the option, the option would also move less than 1. Thereby, in the money call option with a very strong delta will move in tandem with the underlying. Courtesy: Sentrix, JPM, and Saxobank

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts