As a sharp sell call by slow stochastic as %D line cross over exactly above 80 levels, this bearish view is also supported with 14 day RSI.

Currency Derivatives Insights: (GBPUSD)

With a hedging perspective of GBP FX exposure the below strategy is advocated.

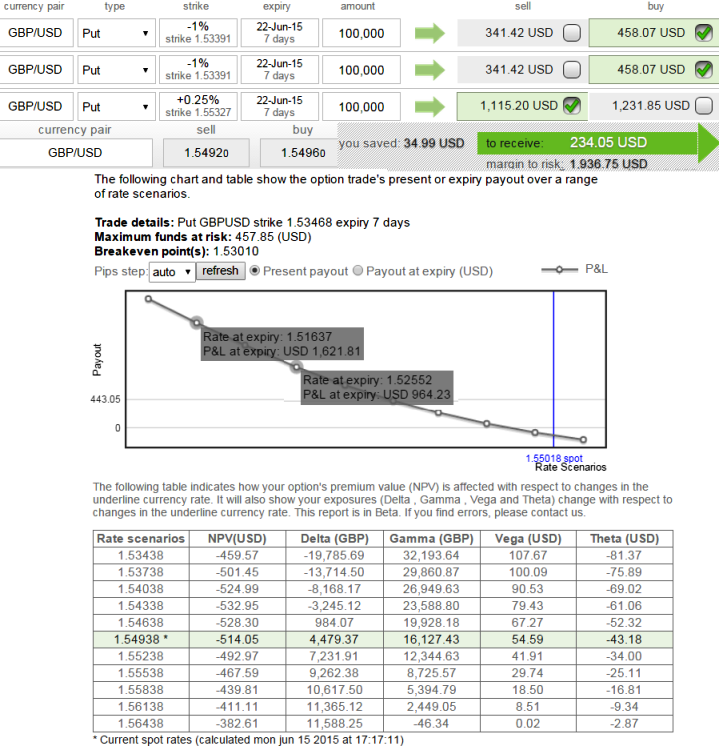

Arrest downside risks of these pairs hedging through deploying option strategy: Put Ratio back spread

Add 2 lots of longs on Out-Of-The-Money -0.25 delta puts (strike at 1.5341) with negative 43.18 theta and short 7D +0.25% In-The-Money put (strike at 1.5532) with positive theta value, usually in a ratio of 2:1.

Expect the exchange rate of this pair to tumble at least 300+ pips in the near term basis to make a larger downside moves.

As shown in the diagrammatic representation, net credits from short side can finance 2 lots of OTM put options.

However, huge margin is required to short ITM puts.

The higher strike short puts finances the purchase of the greater number of long puts and the position is entered for no cost or a net credit.

The exchange rate of GBPUSD has to make substantial move on the downside for the gains in long puts to overcome the losses in the short puts as the maximum loss is at the long strike.

FxWirePro: Hedge GBP/USD with 2:1 PBRS, most likely to breach trend line support

Monday, June 15, 2015 12:04 PM UTC

Editor's Picks

- Market Data

Most Popular

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?