Key Economic Fundamentals:

The CAD against JPY eased further in this week despite positive flashes of Japanese trade balance and disappointing retail sales in Canadian data.

The FxWirePro Canadian dollar index weakened but Japanese Yen index indicates more bearish environment on account of yesterday’s retails sales data in Canada, that is printed disappointing number (actual 0.0% versus forecasts at 0.6% and previous 0.2%).

Japan prints a JPY 496.2 billion trade surplus in October of 2016, 373.5 pct higher than a JPY 104.8 billion surplus a year earlier but lower than market expectations of JPY 615 billion. Exports declined 10.3 pct year-on-year, 13th consecutive drop and much worse than expectations of an 8.6 pct fall. Imports shrank at a faster 16.5 pct compared to forecasts of a 16.3 pct decrease.

On the data front, Canada is waiting for OPEC meeting, GDP MoM flashes, and unemployment claims during next week, trade balance, and BoC’s monetary policy is scheduled for 1st week of December. While Japan eyes on inflation report in this week.

OTC outlook & Hedging Framework:

As stated in our recent technical write up, CADJPY spot has been able to break out stiff resistances of 78.639 and 79.816 levels and see intensified buying momentum in consolidation phase amid major downtrend, and as a result CFDs of this pair slightly have been gaining upside traction.

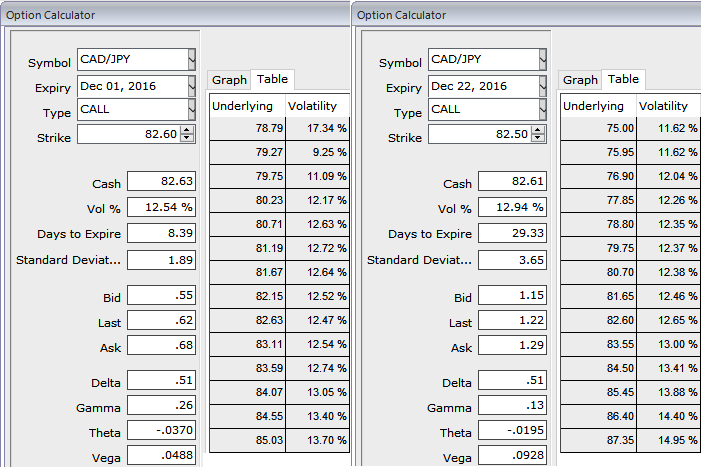

You could probably observe the implied volatility of 1w CADJPY ATM contracts are spiking higher 12.54% and 12.94% for 1m tenor.

Well, amid this high yielding implied volatility times, we devise below option strategy that could optimally utilize IV benefits since we have long positions in this formulation. And higher IVs are conducive for option holders.

Strategy: Option straps

Combination ratio: (Long 1: Long 1: Long 1; 2:1 Call/Put).

Rationale: Since underlying spot FX is edging up with mild upswings and has cleared stiff resistances we want to favour short-term bullish sentiments, but on the flip side the major downtrend cannot be ruled out completely that would likely result in positive cash flow on expiration as the pair goes adverse to you as it approaches next supply zones at 84.578 levels. In this scenario, we balance FX option portfolio capitalizing on higher yielding IVs.

We trust that the pair may move in either direction but capitalizing on steady IVs with significant data drivers in the given timeframe that could bring in considerable IV spikes, Gamma of ATM strikes would factor in option values, thus such ATM instruments seem more beneficial and deploy in our strategy.

The Execution: Go long in 2 lots of CADJPY 1M at the money +0.51 delta call and longs in 1 lot of 2M at the money -0.49 delta put at net debit.

2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different