Asian equities are up sharply overnight supported by hopes that the G20 meeting of global leaders will result in an easing of trade tensions between the US and China, while EMFX ques are little edgy. USD is quiet into month/quarter end and G20 risk, the US Treasury Secretary Mnuchin described the upcoming meeting as “very important”. The G20 begins early tomorrow UK time but the meeting between US President Trump and Chinese President Xi is currently scheduled for Saturday.

We have a date and a time: the much anticipated Trump-Xi meeting will take place at 11:30 am on Saturday (29 June) in Osaka. It is reported that both sides tentatively agreed on a trade truce before the G20 meeting, and a pre-condition for President Xi to attend this summit was that the US should delay the new tariffs. There were also reports suggesting that both sides are working out another deadline for the trade deal, which might be six months (end of this year). In addition, a joint press release could be expected instead of separate statements as US and China did before.

Steven Mnuchin, the US Treasury Secretary, said yesterday that a trade deal with China is 90% complete. This piece of news, in my opinion, carries little information. As China always says, anything is negotiable before a deal is done. Hence, 90% is not that different from 1% nor 99.99%.

However, CNY and CNH strengthened somewhat on this news. Again, it is the show time of President Trump. Trump said in a later TV interview that if the trade talks don’t end well this weekend in Osaka, he would go ahead with taxing all the Chinese goods. However, he raised a new idea: to impose 10% tariff on the remaining USD300bn worth of Chinese products, as this could be easier to be handled by the American families.

CNY and CNH pared all the gains after Trump's interview. This movements in the FX market is understandable, but nobody knows what would happen this weekend, and therefore the market positions should be quite lean for the time being.

Hence, we run you through OTC updates and advocate below FX derivatives strategies accordingly.

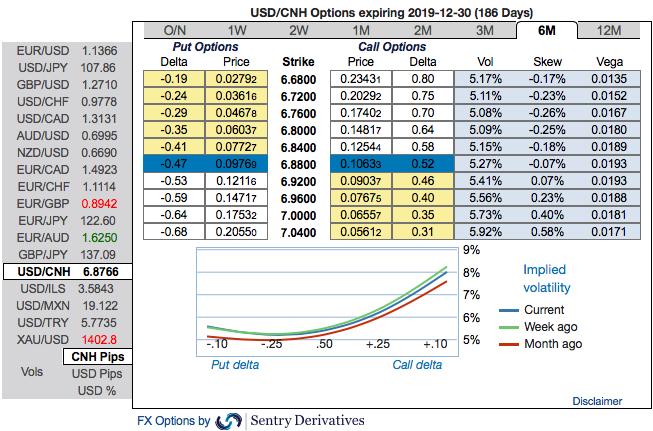

OTC FX updates: You could easily make out that the positively skewed 3m IVs of USDCNH have been stretched out on either side, whereas 6m skews are indicating upside risks. Bids for OTM call strikes up to 7.04 levels are observed (refer above nutshell). This is interpreted as the hedgers’ sentiments are inclined towards upside risks than the downside.

Trade tips: Buy 6M 40D (6.76 strike) USD calls/CNH puts vs sell 1M OTM calls of 7.10.

Emerging Asian currencies are vigilant against possible weakness in the Chinese yuan. US President Donald Trump notified Chinese President Xi Jinping that a 25% tariff would be levied on the remainder USD325bn worth of Chinese goods if both leaders fail to meet at the G20 Summit on June 28-29th. The 12M NDF outright for USDCNY has, for the first time since last November, started to test the psychologically critical 7 levels again. Courtesy: Sentrix, JPM & Commerzbank

Currency Strength Index: FxWirePro's hourly CNY is flashing at -33 (mildly bearish), hourly USD spot index was at 32 (which is mildly bullish) while articulating (at 13:33 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data