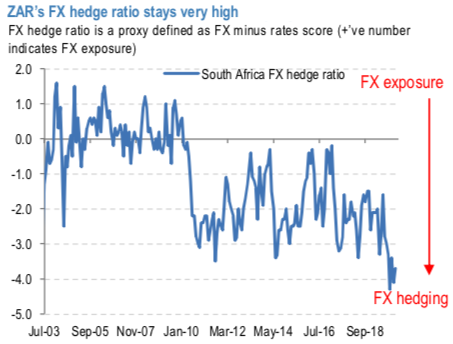

There are some technical positives for ZAR, which under normal circumstances may be sufficient to stabilize the currency, but amid end-of cycle concerns are probably not a good guide. For completeness, we review valuation and positioning below. Despite the small correction in March, the FX hedge ratio remains near record highs (refer 1st chart).

This suggests many real money investors are already pre-hedged for the upcoming downgrade risks. In addition, ZAR now screens 8.1% cheap in our BEER FV model, the lowest since September 2018 (refer 2nd chart). These technical positives somewhat reduce ZAR’s vulnerabilities.

The medium term outlook for ZAR remains very negative based on weak growth, prospects of much lower carry and a negative BoP dynamics. Yet, our risk appetite index has reached extreme low levels and ZAR is starting to screen cheap in our BEER FV model. As such we took profits on our bearish trades. Lacking directionality though momentum to keep USD/ZAR above 18.00 levels.

Consider a RUB – ZAR RV trade, supported by the earlier screener on skews: Sell 3M delta-hedged USDRUB 25D call @10.9/11.3 and hedge it with 3M delta-hedged USDZAR 25D call @16.325/16.725, equal vega. Courtesy: JPM

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts