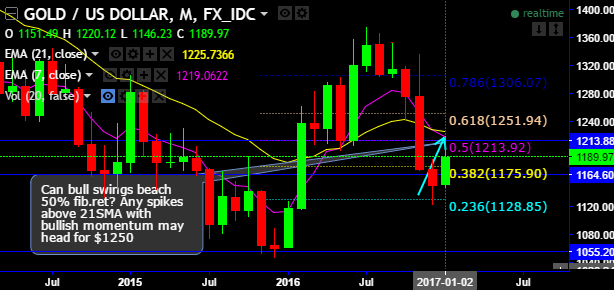

Gold prices in January series have retraced back above 38.2% Fibonacci retracements from the lows of six months downtrend (i.e. 1122.81 levels), earlier the upswings have hit 50% but could not sustain to slide to the current 1190 levels.

OTC outlook:

The current implied volatility of 1m ATM XAUUSD contracts are at 12.45% and above with positive skews signifying hedgers interests are in well balanced on either side but slightly biased towards OTM call strikes, and it is likely to spike higher for 1m tenors.

While delta risk reversals substantiate these figures with upside risk sentiments (observe positive shifts across different tenors). By this, we mean guaranteed hedge at the higher strike (worse than the outright forward rate if unleveraged) in order to benefit from a favorable market move down to the lower strike.

US yields have retreated off their mid-December highs and gold prices have simultaneously increased more than 5%. Given the looming, largely uncertain, catalyst of the US inauguration and the launching of the first 100 days of Trump’s presidency, we decided to lock in our gains and close our position at today’s settlement price of $1,196.60/oz for a gain of 6%.

Although the major trend has been puzzling, the moment in short-term upswings is intensified while six months downtrend can also not be disregarded, accordingly, we’ve formulated below hedging strategy using option contracts.

Hedging Strategy: Option straps (XAU/USD)

As the risk reversal numbers allow for a customized hedging solution, tailored to your risk and hedging profile contemplating both side risks. Risk Reversals are OTC derivative instruments and the notional amount does not need to be tied up throughout the full tenor of the trade.

Hence, we recommend deploying hedging strategies to arrest upside risks with longs positions in 2 lots of ATM vega calls with 1M expiry and 1 lot of ATM vega puts of similar expiries.

Vega instruments are preferred as it takes care of the sensitivity of an option’s value to a change in volatility. It is usually expressed as the change in premium value per 1% change in implied volatility.

As shown in the diagram, the Vega of a long call option position is USD138 and IV increases or decreases by 1%, the option’s premium will increase or decrease by USD138, respectively.

Subsequently, this XAUUSD option straps strategy would take care of ongoing upswings and abrupt downswings and yields handsome returns.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics