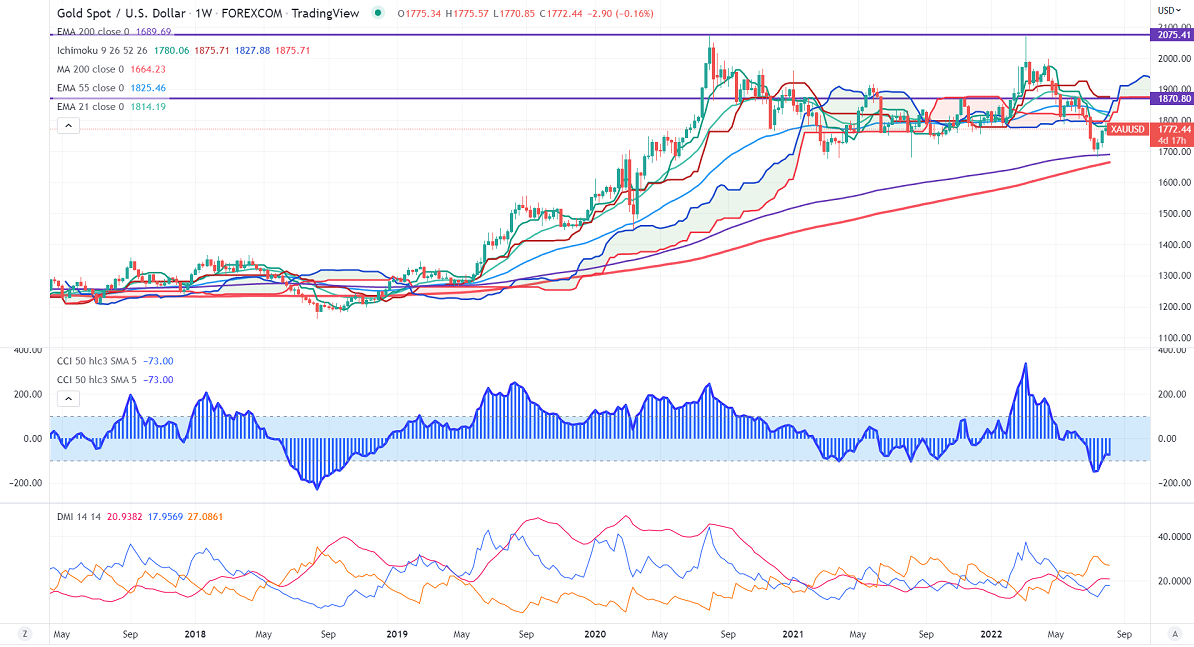

Ichimoku Analysis (Weekly Chart)

Tenken-Sen- $1780.06

Kijun-Sen- $1875

The gold price pared some of its gains after upbeat US jobs data. US economy has added 528000 jobs in July, much better than the economist forecast of 258000. The unemployment rate came at 3.5% vs. an estimate of 3.6%. The pullback in the US dollar index due to geo-political tension between China and Taiwan also puts pressure on the yellow metal. According to the CME Fed watch tool, the probability of a 75 bpbs rate hike in Sep rose to 69.50% from 28% a week ago.

The number of people who have filed for unemployment benefits rose by 6000 to 260000 for the week ended July 30 vs. 262000.

Factors to watch for gold price action

Global stock market- Mixed (neutral for gold)

US dollar index – Bullish (negative for gold)

US10-year bond yield- Bullish (negative for gold)

Technical

The near–term support is around $1760, a breach below targets $1750/$1738/$1720.Significant reversal only below $1650. The yellow metal faces minor resistance around $1800, breach above will take it to the next level of $1820/$1840.

It is good to buy on dips for around $1750 with SL around $1735 for TP of $1800/$1820.