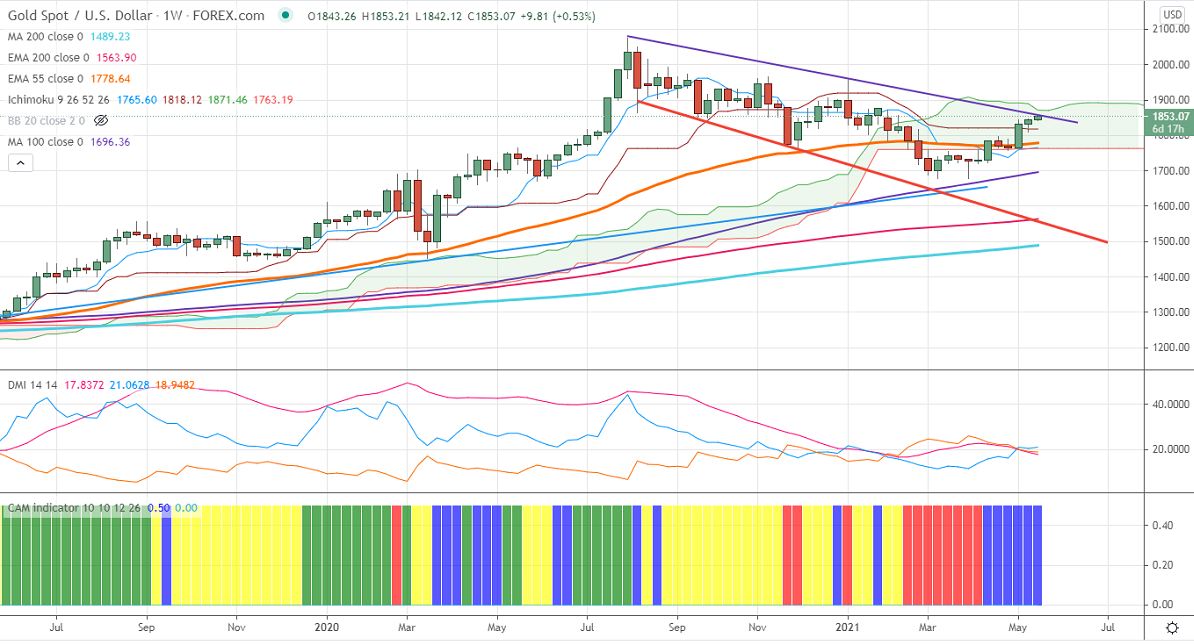

Ichimoku analysis (Weekly chart)

Tenken-Sen- $1762

Kijun-Sen- $1818

Gold has recovered sharply after hitting a low of $1808 on broad-based US dollar selling and weak US economic data. The US dollar index lost more than 50 pips after a pullback to 90.90. The minor sell-off in US bond yield also supporting the yellow metal at lower prices. The US-10-Year bond yield declined more than 5% from minor top 1.705. The yellow metal hits a high of $1853 and is currently trading around $1852.90.

Economic data:

US retail sales came unchanged at 0.0% in Apr compared to a huge jump of 10.7% the previous month. The core retail sales dropped to -0.8% vs an estimate of -0.5%. The University of Michigan consumer sentiment for Apr came at 82.8 much lower than the forecast of 90.

US CPI rose by 0.8% in Apr much better than the forecast of 0.2%. The annual inflation surged to 4.2% in Apr from 2.6% in Mar, the highest level in 13 years.

Technical:

The immediate support is around $1845 (resistance turned into support), violation below targets $1820/$1802/$1790/$1760. Significant trend continuation only below $1675. On the higher side, near-term resistance is around $1855 (trend line resistance), any break above confirms bullish continuation. A jump to $1873/$1900.

It is good to buy on dips around $1845 with SL around $1830 for the TP of $1895.