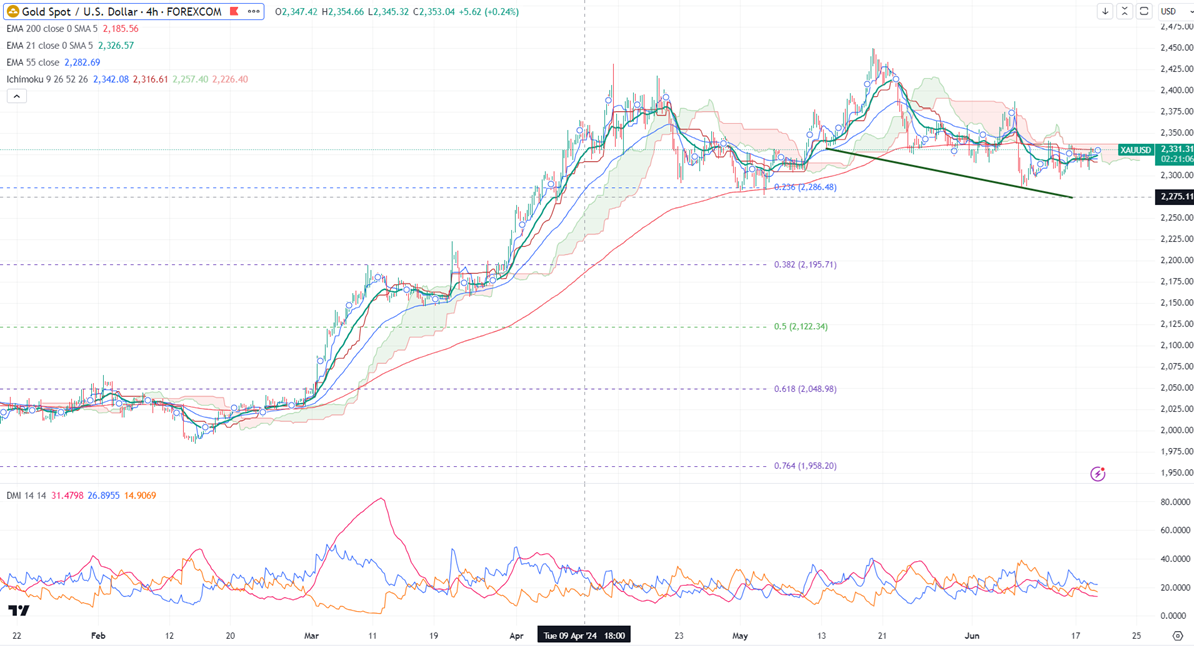

Ichimoku Analysis (4 Hour chart)

Tenken-Sen- $2319.92

Kijun-Sen- $2316.17

Gold gained after weak US retail sales data.It hit a high of $2333.20 yesterday and is currently trading around $2331.

US retail sales- Weak (bullish for Gold). Yesterday’s weaker US data has increased the chance of an early rate cut by the Fed this year.

Fed members - Hawkish comments (negative for gold)

According to the CME Fed watch tool, the probability of a 25 bpbs rate cut in Sep increased to 61.70% from 46.80% a week ago.

US dollar index- Bullish. Minor support around 104/103. The near-term resistance is 105.50/107.

Factors to watch for gold price action-

Global stock market- Bullish (negative for gold)

US dollar index - Bullish (negative for gold)

US10-year bond yield- Bearish (Positive for gold)

Technical:

The near–term support is around $2280, a break below the target of $2270/$2250/$2228. The yellow metal faces minor resistance around $2340 and a breach above will take it to the next level of $2350/$2375.

It is good to buy on dips around $2300-02 with an SL of around $2280 for a TP of $2372.

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data