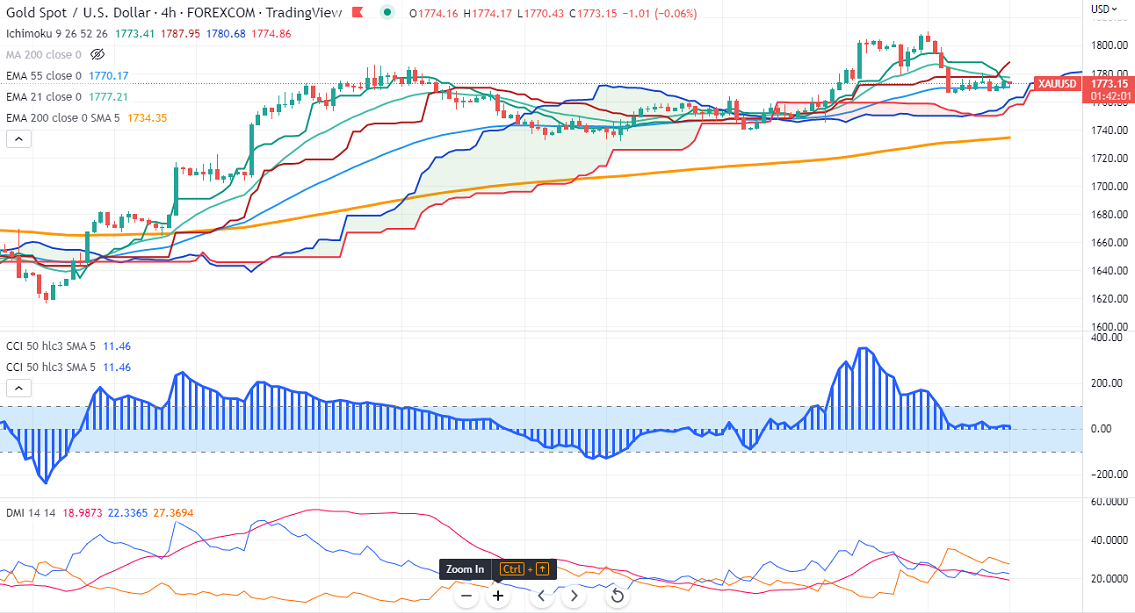

Ichimoku Analysis (4- Hour chart)

Tenken-Sen- $1775.30

Kijun-Sen- $1783.92

Gold consolidates in a narrow range between $1765 and $1780.93 for the past two days. The yellow metal pared some of its gains as market sentiment improved on easing Covid restrictions. The yellow metal hits a low of $1770.43 and is currently trading around $1770.96.

US dollar index- Bearish. Minor resistance around 106.20/107.25. The near-term support is at 103.90.

According to the CME Fed watch tool, the probability of a 50 bpbs rate hike in Dec rose to 77% from 66.3% a week ago.

The US 10-year yield lost more than 2.5% from yesterday's high of 3.61%. The US 10 and 2-year spread widened to -82.2 basis points from -67 bpbs.

Factors to watch for gold price action-

Global stock market- Bullish (negative for gold)

US dollar index – Bearish (Positive for gold)

US10-year bond yield- Bearish (Positive for gold)

Technical:

The near–term support is around $1760, a break below targets of $1740$1720/$1700. The yellow metal faces minor resistance around $1820, breach above will take it to the next level of $1860/$1900.

It is good to buy on dips around $1760 with SL around $1740 for TP of $1860.