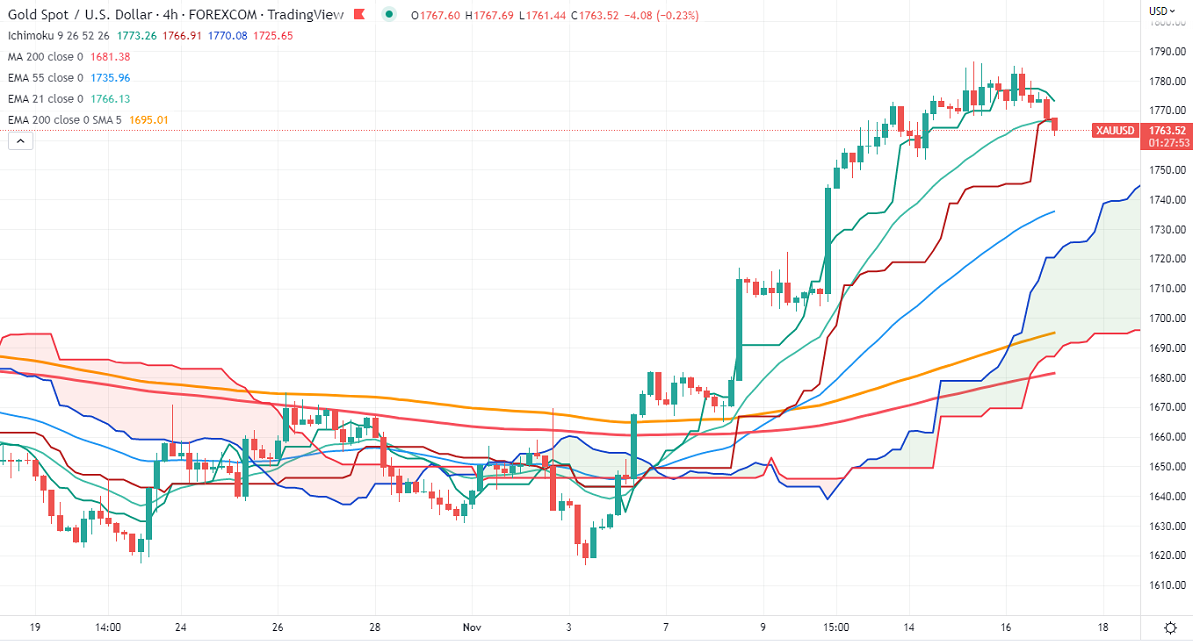

Ichimoku Analysis (4-hour chart)

Tenken-Sen- $1776.19

Kijun-Sen- $1766.91

Gold pared some of its gains despite the weak US dollar. North Korea fired a ballistic missile and warns the US of a "fiercer military response". The escalation of geo-political tension between Russia and Ukraine also supports the yellow metal at lower levels.

US retail sales rose 1.3% in Oct, above the estimate of 1%. Markets eye US Philly fed manufacturing index and Fed member Bullard speech for further direction.

According to the CME Fed watch tool, the probability of a 50 bpbs rate hike in Dec increased to 85.4% from 56.8% a week ago.

The US 10-year yield lost more than 13% after hitting a high of 4.244%. The US 10 and 2-year spread widened to -65 basis points from -57 bpbs.

Factors to watch for gold price action-

Global stock market- Bullish (negative for gold)

US dollar index – Bearish (Positive for gold)

US10-year bond yield- Bearish (Positive for gold)

Technical:

The near–term support is around $1740, a break below targets of $1720/$1700/$1680. The yellow metal faces minor resistance around $1775, breach above will take it to the next level of $1800/$1840.Minor bullish continuation only if it breaks $1803.

It is good to buy on dips around $1760 with SL around $1740 for TP of $1800/$1840.