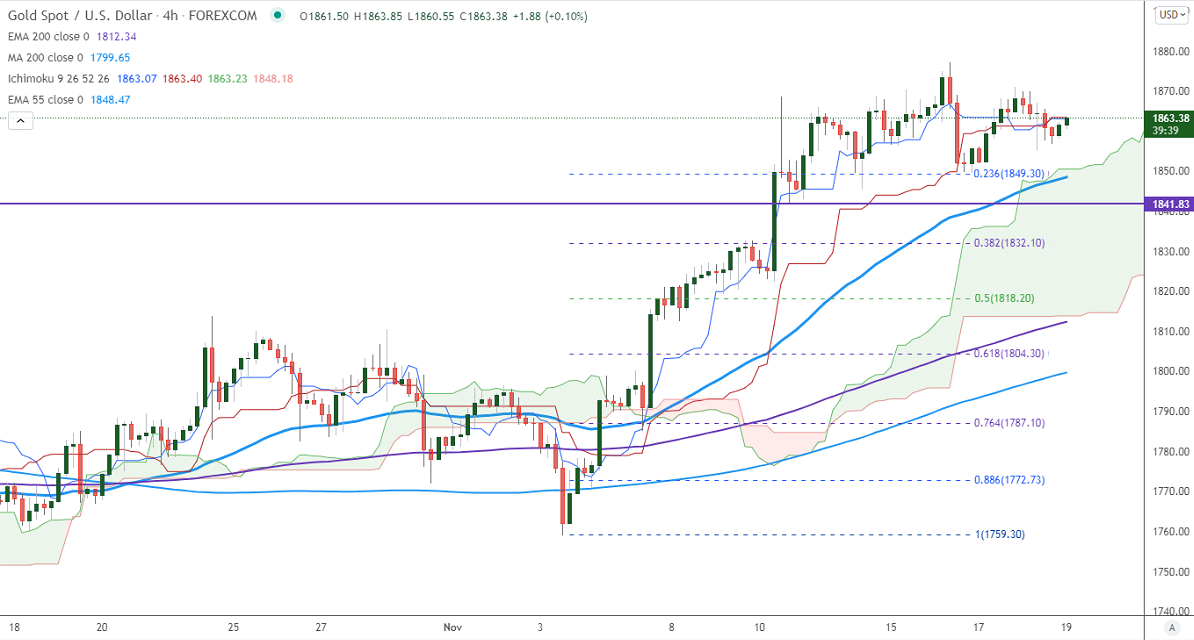

Ichimoku analysis (4 Hour chart)

Tenken-Sen- $1863.07

Kijun-Sen- $1863.40

Gold jumped after hitting a low of $1856 yesterday after jobless claims data. The number of people who have filed for unemployment benefits for the week ended dropped by 1000 to 268000 previous week compared to forecast of 260000. The minor profit booking in the US dollar index also supports the yellow metal at lower levels. A decline to 95.40 is possible. Markets eye US Fed member speech for further direction. It hits an intraday high of $1863.85 and is currently trading around $1863.41.

Factors to watch for gold price action-

Global stock market- Slightly Bullish (negative for gold)

US dollar index –Bearish (positive for gold)

US10-year bond yield- Bearish (positive for gold)

Technical:

It faces strong support at $1849, violation below targets $1840/$1820/$1798/$1780. Significant trend continuation only below $1675. The yellow metal facing strong resistance $1875, any breach above will take to the next level $1900/1915 is possible.

It is good to sell on rallies around $1870 with SL around $1880 for TP of $1800.

FxWirePro- Gold Daily Outlook

Friday, November 19, 2021 5:23 AM UTC

Editor's Picks

- Market Data

Most Popular