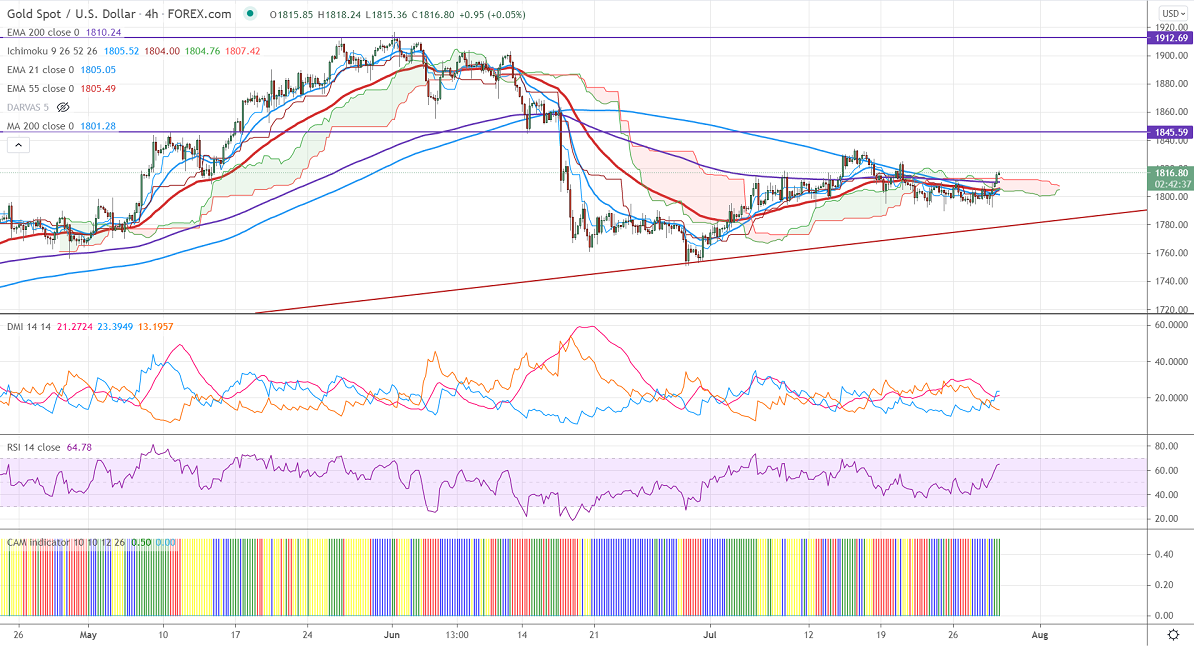

Ichimoku analysis (4-hour chart)

Tenken-Sen- $1805.21

Kijun-Sen- $1803.69

Gold is holding above $1800 after Fed monetary policy. The Fed has kept its rates unchanged as expected and to continue bond-buying for at least by Dec 2021. The central bank has said that "the economy has made progress" toward the goals of maximum employment and price stability".

The US 10- year yield has shown a little movement after no changes in assets purchases. The yellow metal hits an intraday high of $1817.53 and is currently trading around $1816.36.

Economic data:

Markets eye US Advance GDP q/q and jobless claims for further direction.

Factors to watch for gold price action-

Global stock market- Slightly bearish (positive for gold)

US10-year bond yield- Neutral

US dollar - Bearish (positive for gold)

Technical:

It is facing strong support at $1790 violation below targets $1780/$1765. Significant trend continuation only below $1675. On the higher side, near-term resistance is around $1805, any convincing break above will take the yellow metal $1825/$1835/$1860/$1900 is possible.

It is good to buy on dips around $1800 with SL around $1790 for TP of $1850.