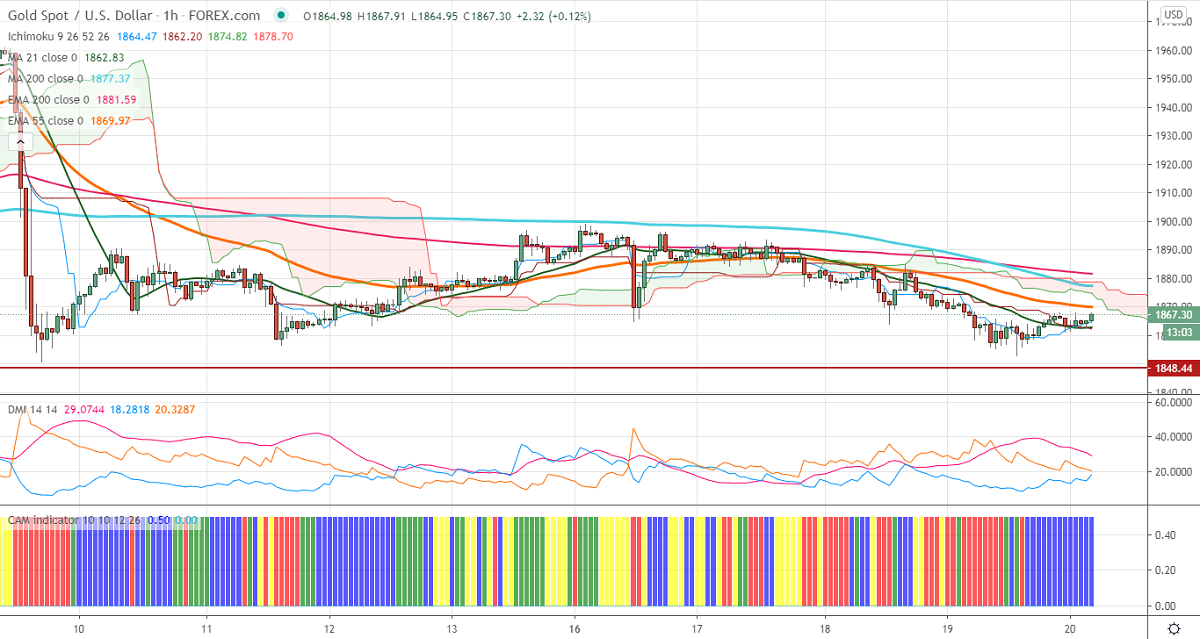

Ichimoku analysis (1-Hour chart)

Tenken-Sen- $1864

Kijun-Sen- $1862

Gold has shown a minor dead cat bounce from a low of $1852. Short term trend is still on the weaker side as long as resistance $1900onis trading slightly weak and struggling to close above $1900. The rising number of coronavirus cases offsets COVID-19 vaccine optimism. The number of new cases in the U.S rose by 200000 on Thursday, the number of daily death hits the highest level since May 7th. The dollar index showed a minor jumped above 200-H MA, started to decline. The U.S 10-year yield lost more than 17% after hitting a multi-month high.

Economic data:

The number of people who applied for unemployment benefits rose by 31000to 742000 vs an estimate of 707k. The Philly fed manufacturing index dropped to 26.3 in November but slightly better than the estimate of 22.

Technical:

The intraday resistance to be watched is $1870 (55- EMA), any violation above targets $1881/$1900. On the lower side, near term support is around $1848 and any indicative break below that level will take till $1830/$1800.

It is good to sell on rallies around $1898-1900 with SL around $1921 for the TP of $1849.