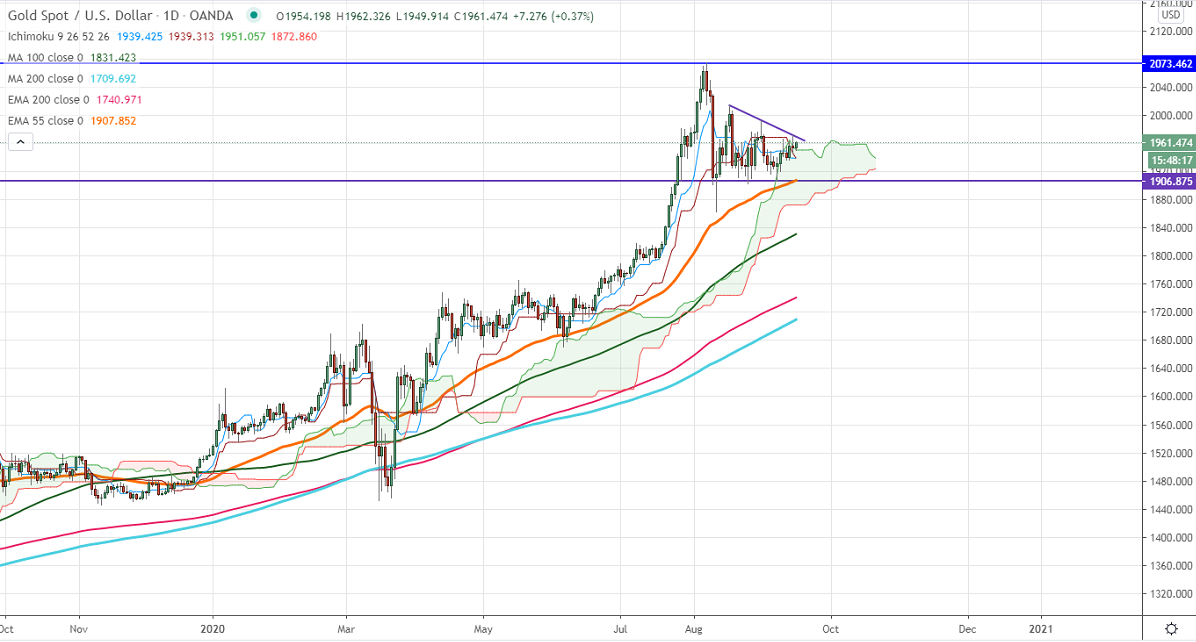

Ichimoku Analysis (1-hour Chart)

Kijun-Sen- $1955.70

Tenken-Sen-$1960

The gold is trading in a narrow range between $1992 and $1906 for the past two weeks. Markets eye the US fed monetary policy today for further direction. The Fed is planning to hold rates unchanged and investors look for economic projection. US dollar index is holding slightly above 93 levels, any violation above 94 will confirm bullish continuation. It hits an intraday high of $1961.50 and is currently trading around $1960.17.

On the lower side, near term support is around $1948, and any violation below targets $1940/$1921/$1900. Significant selling only below $1860. A dip till $1780/$1670 is possible.

The near term resistance is around $1970, indicative break beyond will take the commodity till $1992/$2000/$2015.

It is good to buy on dips around $1958-59 with SL around $1948 for the TP of $2015.