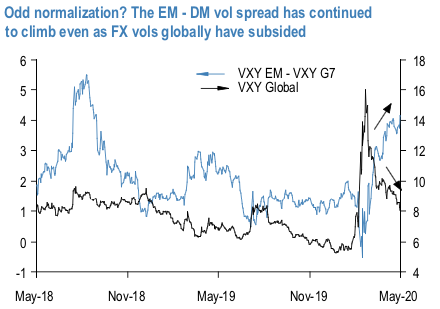

The traditionally fearsome risk-unfriendly May seasonality has come and gone without much of a flutter in FX option markets. FX vols globally continued to melt lower all month, US/China tensions notwithstanding, and by now have retraced 80% of their 1Q’20 spike. The most notable feature of this normalization is that it has been predominantly G7 led, as reflected in a steady climb higher in the EM – DM vol spread over the past two months (refer above chart).

In addition to the continued richness of risk-reversals on vol surfaces across the board, this is the most noteworthy manifestation of lingering nervousness and/or long memory

of the earthquake in financial markets earlier in the year.

The outlook on the macro risk backdrop, and by extension currency volatility gets murky from here. On the one hand, the vol dampening / spread compressing impact of central bank liquidity is in full flow across assets, oil prices have rebounded sharply, and even normalization laggards such as EM FX with more-than-justified indebtedness concerns – and with it the broad dollar – are showing signs of succumbing to the rush of optimism coursing through markets.

At the same time, new risks in the form of a worrying escalation in US/China tensions have surfaced, and value in playing for additional G10 (and especially G3) vol compression has disappeared given the wider disconnect between low vol and poor activity data. These offsets do not lend themselves to high conviction, directional vol views at present, hence our alpha recommendations strive to maintain a semblance of balance between a core collection of vol-surface carry trades cantered on fading rich risk- reversals with a set of defensive relative value constructs.

In the spirit of abstaining from big macro vol calls, we zero in on two relatively micro-distortions in the Yen option complex – a corner of the FX option market that has suffered disproportionately from the ongoing collapse in G3 vol.

First, we propose a low maintenance option construct for fading rich risk-reversal / ATM ratios for investors without the bandwidth to actively hedge deltas.

Second, we highlight the historically anomalous tightness of cross-yen vs. USD-vol spreads with specific reference to GBP, which is susceptible to a potentially turbulent month of Brexit negotiations leading up to the Withdrawal Agreement extension deadline in end-June and worth hedging convexly with GBPJPY – GBPUSD gamma spreads. Courtesy: JPM

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data