We have revised down our forecasts for AUDUSD in the wake of a global easing cycle and intensifying risks to both domestic and global growth. We now expect AUDUSD to end the year at USD0.60 (prior forecast was USD0.64), with a Sep-20 forecast of USD0.62. The combination of weaker domestic growth (we now forecast calendar year growth of 2.1%, vs.

2.8% in early 2020), risks to global growth and the prospect of QE sooner than expected should all work to open up further downside for AUD. Rising equity market volatility should also help to reassert AUD's inherent sensitivity to global cyclical dynamics.

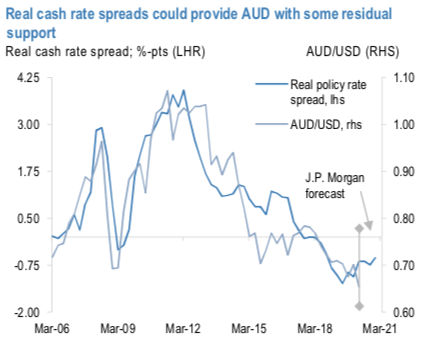

Real rate spreads and commodity prices might provide some support for AUDUSD, but global growth is likely to be more influential on AUD. The Fed delivered an inter-meeting rate cut this month, and our US economists now expect expect another 25bp cut at the March FOMC meeting. They also now think there is a 50:50 chance of reaching the effective lower bound this year in the US. The prospect of much lower USD rates means that real rate spreads could work against AUD. As 1st chart shows, this dynamic is already in train. Prices of Australia’s commodity exports have held up reasonably well in recent weeks despite downward revisions to global growth forecasts (refer 2nd chart). But in the end, we suspect that AUD will remain more sensitive to the global growth outlook (refer 3rd chart), and so we don’t expect commodity prices or real rate spreads to prevent further depreciation of the currency.

The RBA cut rates earlier this month, motivated by a desire to insure against rising risks of a global recession via COVID-19. We expect another 25bp rate cut in April; it is unlikely that the Bank believes that one 25bps easing will be enough to fully insulate the economy against these risks. The Bank adopted a less conditional easing bias in April, suggesting that the hurdle is not low for further rate cuts.

With the RBA cash rate expected to reach the effective lower bound as soon as April (refer 4th chart), QE will be on the radar in Australia.

OTC Outlook of AUDUSD and Options Strategic Framework:

The positively skewed IVs of 3m tenors are also in line with the above predictions, they still signify the hedgers’ interests to bid OTM put strikes up to 0.55 levels (refer 5th chart).

Please also be noted that we see fresh bids for current bearish risk reversals (RRs) setup across all the longer tenors are also in sync with the bearish scenarios (refer 6th chart).

In a nutshell, AUD OTC hedgers’ sentiments substantiate that their risk mitigating activities for the further downside potential has been clear.

Accordingly, diagonal put spreads are advocated to mitigate the downside risks with a reduced cost of trading.

The combination of AUDUSD’s short-term potential to hit 0.60 and fails from there onwards several times amid lower IVs is luring for the OTM put options writers. While the medium-term perspective is attractive for bearish hedges via ITM puts.

The execution of options strategy: At spot reference: 0.5962 level, short 2w (1%) OTM put option with positive theta (position seems good even if the underlying spot goes either sideways or spikes mildly), simultaneously, add long in 2 lots of delta long in 3m (1%) ITM -0.79 delta put options.

We keep reiterating that the deep in the money put option with a very strong delta will move in tandem with the underlying. Courtesy: Sentry, JPM and Saxobank

US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand