The GDT dairy auction overnight resulted in a 5% rise overall, with WMP up 3% and SMP up 10%. The result is roughly in line with earlier futures predictions which had priced in a response to weather affected supply.

AUDNZD upswing momentum starting to turn positive, we target 1.0700+ during the days ahead.

The pair’s prospects in next 1-3 months: Higher to 1.0750 or above, the RBA likely to remain on hold this year while the RBNZ should ease further. Moreover, the cross remains well below fair value estimates implied by interest rates, commodity prices, and risk sentiment.

OTC updates and Options Strategy:

1m at the money implied volatilities of 50% delta calls and puts are trading at around 7-8% which is reasonable as the vols currently are working in the interest of option holders as you can see IVs and corresponding movements in vega.

As a result of the above economic and monetary policy events, the kiwi dollar was lower against the Australian dollar, with AUDNZD edging up at 1.0616, as all key resistance levels are broken, the further upside can’t be ruled out and it is likely to spike higher on account of the NZ central bank further easing cycle is forecasted.

Well, in order to arrest this upside risk and to bet even on abrupt dips, we recommend option strap strategy that favors underlying spot’s upside bais.

You can trade the IV value by monitoring an IV chart for a specific underlying market for a certain time period and determine the IV range. The peaks suggest the option is expensive to buy and the troughs suggest the option is inexpensive.

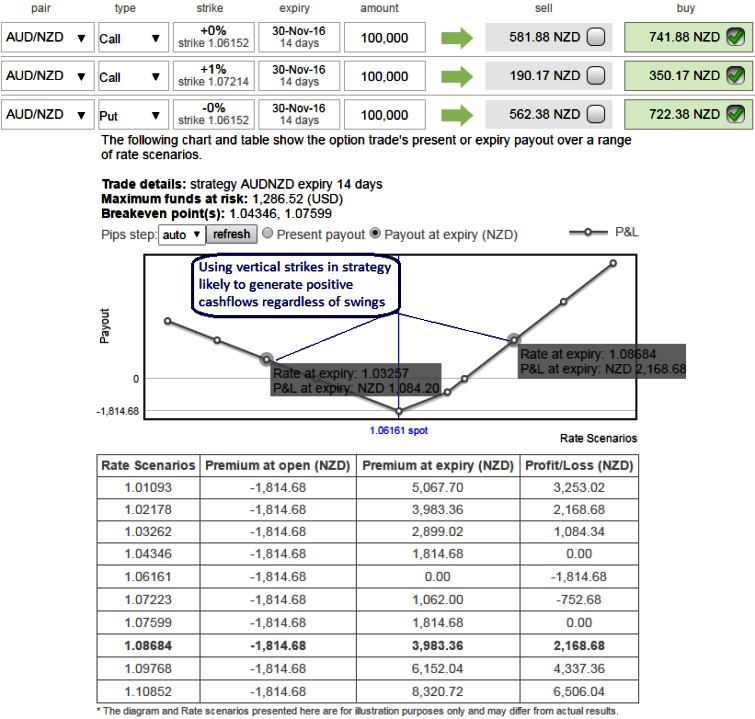

So, we recommend building the FX portfolio exposed to this pair with longs positions in 1 lot of 2W ATM 0.51 delta call, 1 lot of 1m (1%) OTM 0.36 delta call and 1 lot of ATM -0.49 delta puts of 2w tenor.

Since we anticipate upswings in near term as per the signals generated by technicals as well as from IVs and risk reversals, this AUDNZD option straps strategy should take care of both upswings and any abrupt downswings, and the strategy is likely to derive handsome returns on the upside and certain yields regardless of swings on either side as shown in the diagram.

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025