GBPJPY formed a triple bottom around 172.60 and showed a minor pullback. It hits a high of 174.43 and is currently trading around 174.19.

GBPUSD- Trend- Bearish

The pound sterling is trading in a narrow range between 1.25434 and 1.23682 for the past week. Markets eye UK PM Sunak's meeting with US President Biden. Any break below 1.2360 confirms further bearishness.

UK May construction PMI inched higher to 51.60vs 5.10 expected.

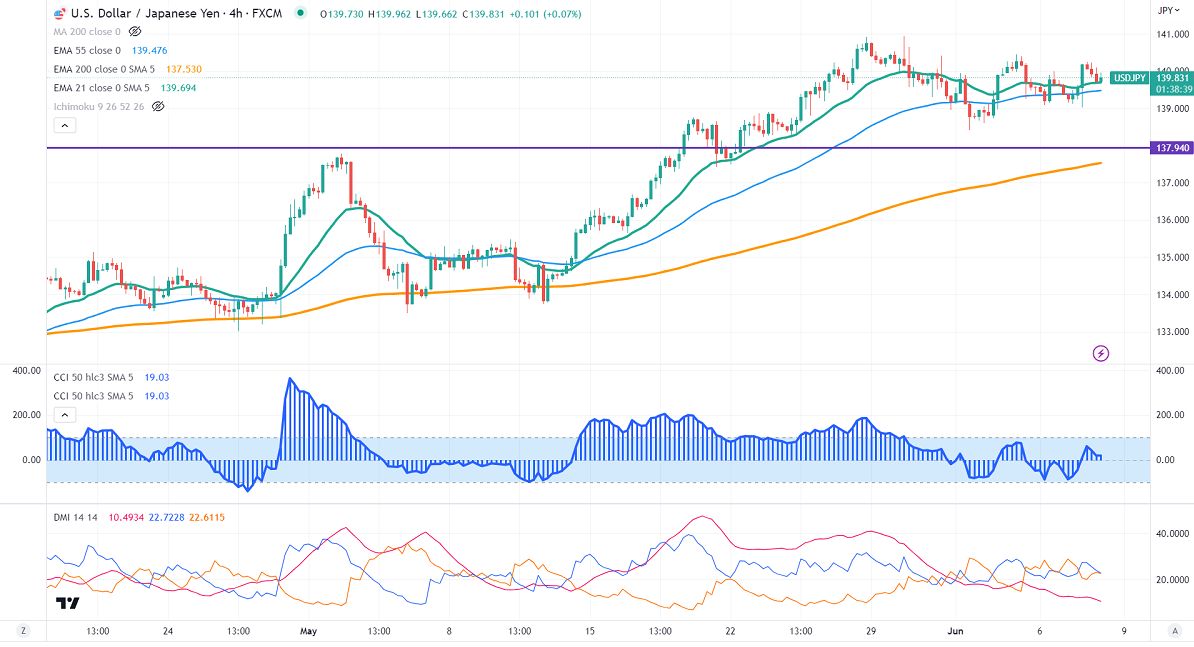

USDJPY- Bullish

The pair recovered on surging US treasury yield. Significant Support is 139/138.40.

GBPJPY analysis-

The near-term support is around 172.50, a breach below targets 171.80/171/170. The immediate resistance is at 175, any violation above will take the pair to 176/177.

Indicators (4-hour chart)

CCI (50)- Bearish

ADX- Bearish

It is good to sell on rallies around 174.25-30 with SL around 176 for a TP of 172.50.