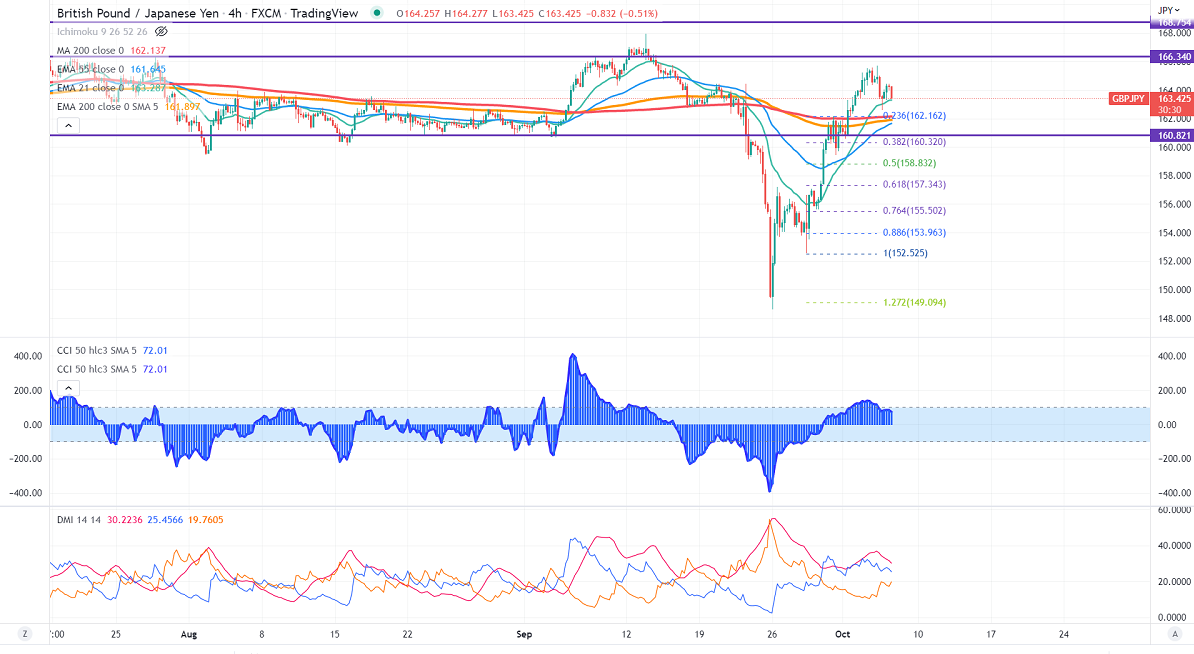

GBPJPY pared some of its gains after Fitch UK's rating outlook. It has downgraded Long term Foreign currency (LFTC) issuer default rating (IDR) to negative from stable and affirmed AA-.Pound sterling lost more than 200 pips from its high of 1.14952. Any close above 1.1500 confirms further bullishness. Technically in the 4-hour chart, holds above short-term 21-EMA, 21 EMA, and long-term 200 EMA (161.88). Any convincing break above 164.50 will take the pair to the next level 165.70/166.35/167. GBPJPY hits an intraday high of 163.45 and is currently trading around 163.55.

The near-term support is around 163.25, a breach below targets 162.70/162/160.30.

Indicators (4-hour chart)

CCI (50) – Bullish

ADX- Neutral

It is good to buy on dips around 163 with SL around 162 for TP of 166.35.