GBP weakness is at the forefront of G10 FX markets as Brexit politics has heated up.

The macro strategies have slashed the sterling forecasts recently as UK politics is increasingly leaning towards a hard Brexit, which raises odds of a larger-than-expected hit to medium term growth and risks worsening an already challenging BoP deficit; we now expect year-end levels of 1.21 on cable and 0.95 on EUR/GBP.

Whereas, the retail sales volumes were unchanged in September, against expectations of a rise (CONS 0.3%, LB CB 0.7%). Strength in today’s report was expected, particularly following August’s retracement. Although the retail biz has disappointed the forecasters, it managed to produce Q3 masks an overall strong quarter.

Nevertheless, some headwinds to retail spending were evident in today’s report and are likely to become more apparent over the medium term. The annual pace of retail price deflation slowed from 1.9% in August to 1.1% last month.

While this year’s 17% depreciation of sterling is a boost to the competitiveness of exporters, it also looks set to drive inflation higher, eating into households’ real incomes. This suggests the likelihood of some rebalancing of UK economic growth as exports pick up and consumption growth is more subdued.

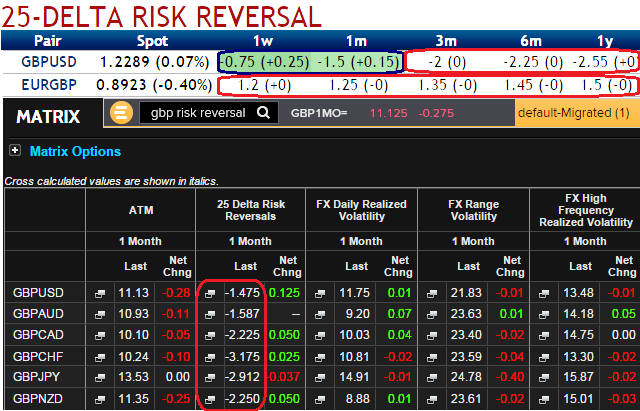

Please be noted that the GBP crosses in the above nutshell, 25-delta risk reversals flashing up with positive numbers in 1w-1m duration that implies the hedgers interests in bullish risks, simultaneously, bearish hedging sentiments in long run remain intact.

Well, this hedging tool could be effectively utilized in following ways:

Safeguarding the company against unfavorable exchange rate fluctuations and potential loss during the implications of article 50 that addresses the procedures of formal EU exit.

Benefitting from favorable exchange rate fluctuations within a specified band when you have the further bearish GBP targets.

Locking in the maximum expenses and the bid price while devising hedging option strategies, selecting top or bottom limit for specific exchange rates.

The transaction can be structured so as to avoid having to pay a premium at the time of entering into the transaction.

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence  Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data

Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk

Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk  Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market

Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran