PM May's vision for UK's clean break from the EU may have removed uncertainty around the Britain’s stance on the issue, but not made Article 50 talks any less thorny or reduced tail risks of a disorderly Brexit. GBPUSD digital puts, GBPCHF 2Y vol and cable 6M6M FVAs are well priced as hedges.

Her speech eliminated any lingering doubts that the UK will pursue a different future outside Europe, and in theory, this removal of uncertainty around the British stance should prove bearish for GBP volatility.

GBPUSD forward volatility (FVAs): Forward volatility is useful to own as a hedge against a political process that is difficult to pin down in terms of timing and hence demands option expressions that can stay alive without rapidly stopping out on theta decay.

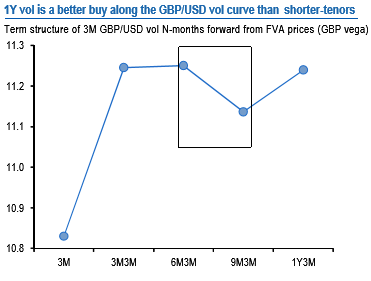

FVAs are essentially gamma-neutral, long vega calendar spreads and efficient in this regard; 1Y tenor GBPUSD vols, in particular, are cheap relative to surrounding points on the curve (refer above chart) and worth owning via 6M6M or 9M3M FVAs that age well as a result of minimal/zero slide along the curve.

Despite the relative cheapness of GBPCHF vols vis-a-vis GBPUSD, the latter is a more realistic target for FVA structures on liquidity grounds.

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure